Resume 2023: How is the e-commerce market performing? What’s the new trend?

In 2023, when the epidemic haze gradually dispersed, the consumer market ushered in a long-lost fireworks atmosphere, and "recovery and recovery" became the most frequently mentioned keyword in 2023. However, the uncertainty in people’s minds has not been completely eliminated, and the low consumer confidence index and the headwind are the status quo in many consumer fields.

So, what is the development of the e-commerce market in 2023? What growth opportunities are hidden in each category? Where is the future layout direction? We reviewed the performance of e-commerce market and popular categories in 2023, analyzed the development status and potential of various types of e-commerce, looked for high growth points and consumption trends of various sub-categories, and made some discoveries worth mentioning.

Summary of provincial version:

1. Macro-economic review: China’s economy showed a positive recovery trend, and the year-on-year GDP growth rate in the first three quarters exceeded the annual target.Consumption becomes the biggest driving force of economic growthOnline and offline consumption has regained its vitality.

2. Overview of e-commerce platform: the layout and strategy of e-commerce platform have been greatly adjusted, and the homogenization is obvious.Actively broaden business boundaries and find incremental markets.

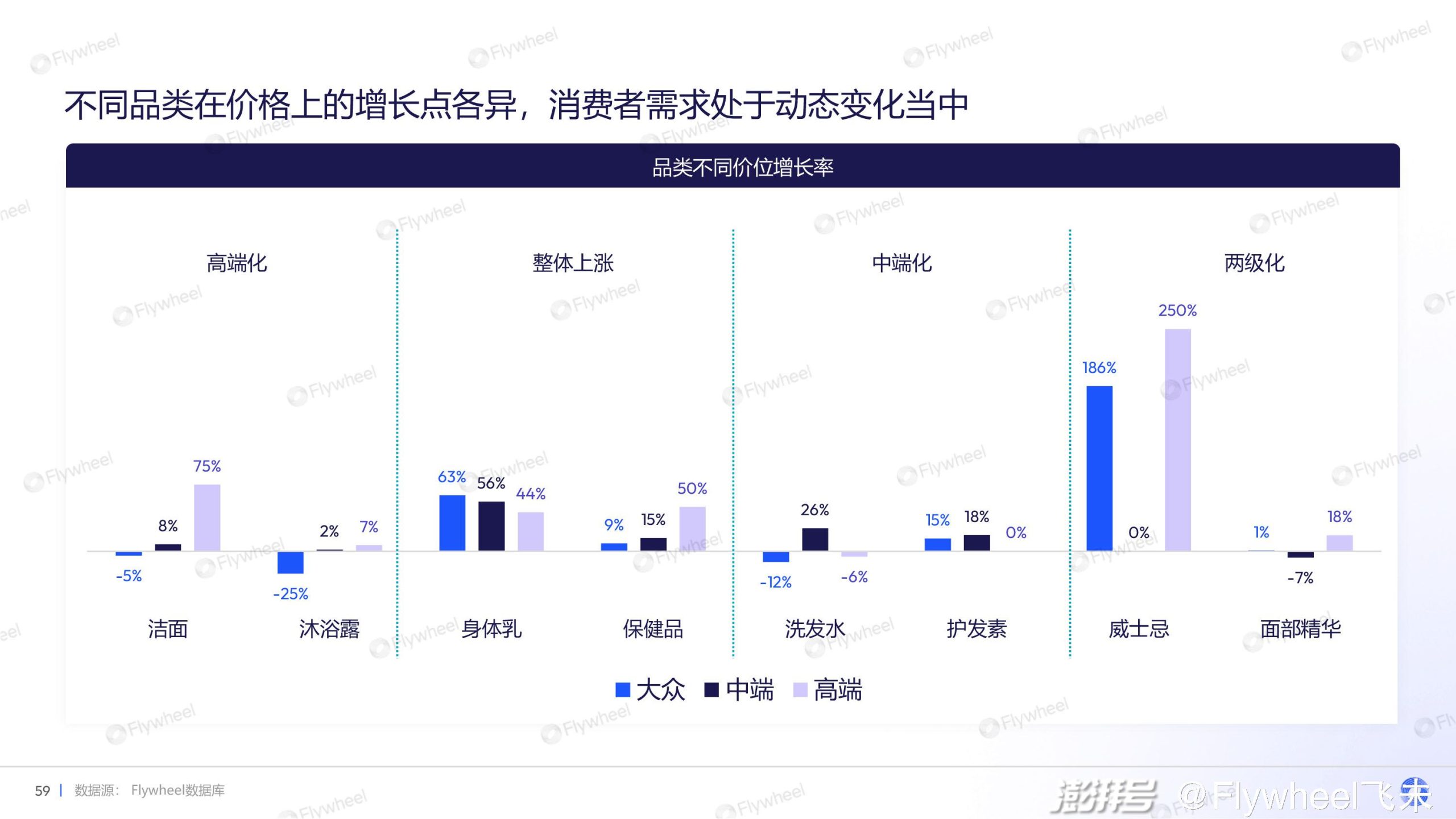

3. Review of popular categories: categories have different growth points in different price bands.Consumer demand is in dynamic change.. Facial skin care, hair care, health, maternal and child, pet products, small household appliances, household cleaning and other categories all increased positively year-on-year, and the average price rose.Consumers pay more attention to the total value of goods.. The proportion of channel in Tik Tok increased,Consumers are gradually increasing their big spending in Tik Tok.

4. Prospect of consumption trends:Consumers are more self-centered and attach importance to instant experience., not simply pursuing the ultimate low price, but improving the quality of life while maintaining the cost performance, alleviating and curing the current pressure.

Macro-economic Review: Online and offline consumption regains vitality.

China’s economy showed a positive recovery trend in the first three quarters of 2023. Compared with the economic growth target set by the government (5%), the year-on-year growth rate of GDP exceeded expectations. It is worth noting that the contribution rate of final consumption expenditure to economic growth has greatly increased year-on-year, which has become the biggest driving force of economic growth and provided strong support for sustainable development.

According to the social zero data, due to the impact of the epidemic in 2022, non-essential optional consumer goods generally declined, and essential consumer goods such as grain, oil and food grew rapidly, among which drugs had the highest growth rate; In 2023, with the release of demand, all consumer goods above designated size resumed positive growth.

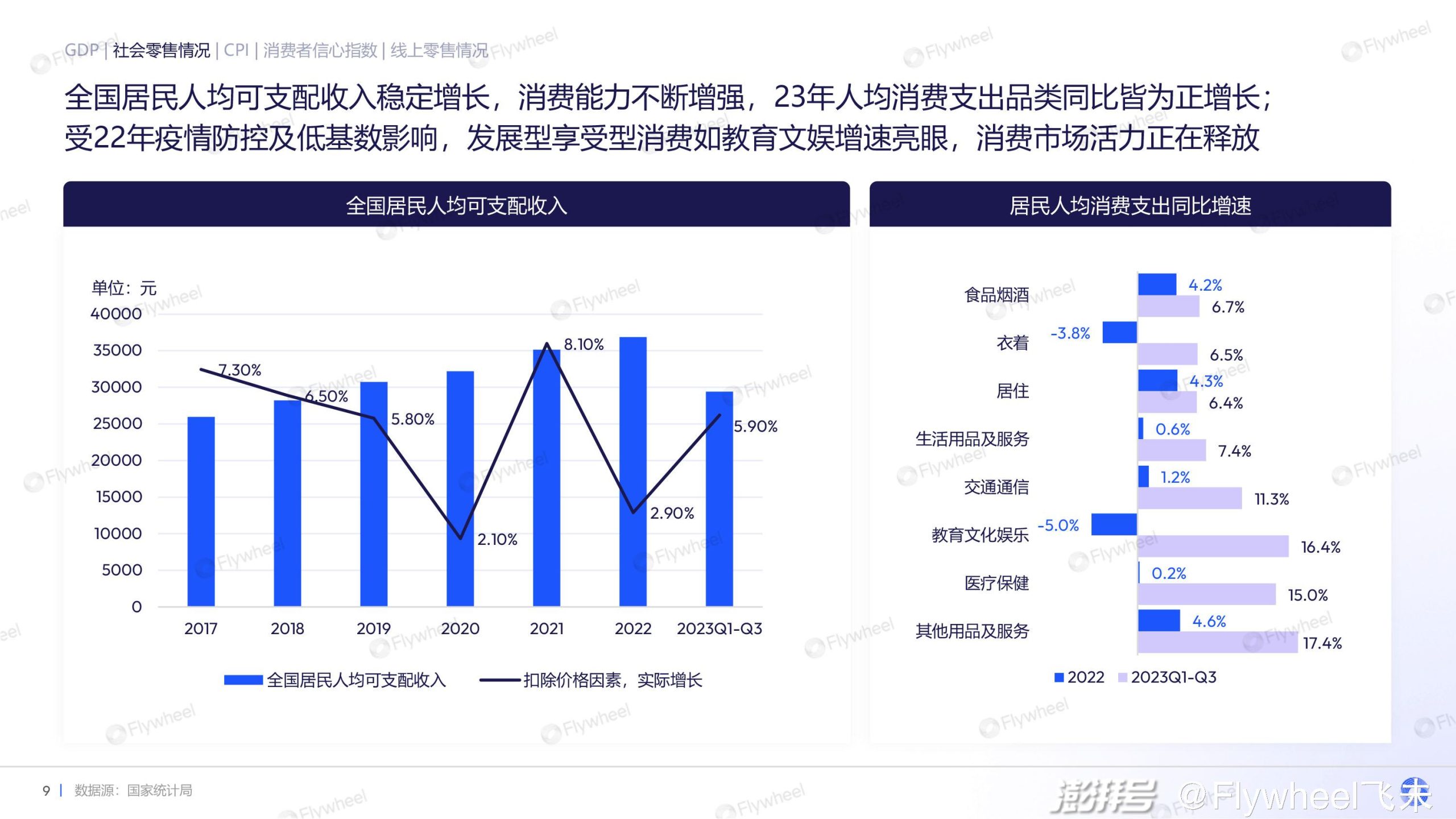

The per capita disposable income of the national residents is also growing steadily, and their consumption power is gradually increasing. In 2023,People’s consumption expenditure shows a positive growth trend in all categories year-on-yearIn particular, the growth rate of developmental enjoyment consumption is very bright.The vitality of the consumer market is gradually being released.. This has brought new opportunities and challenges to various industries, and merchants can more actively meet and meet the diversified needs of consumers.

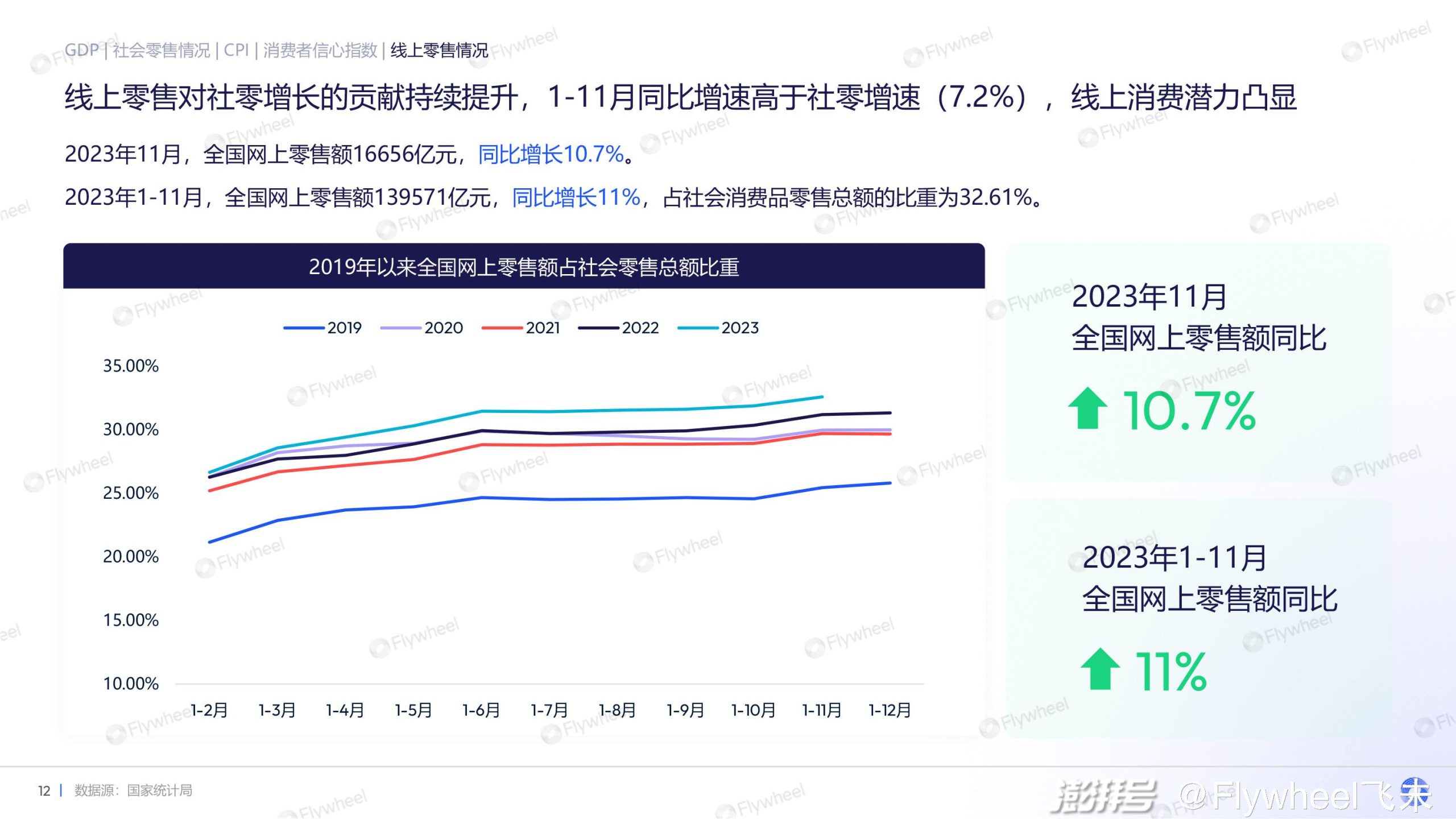

In the past year, online retailing has played an important role in zero social growth. As of November, the year-on-year growth rate of online retail was higher than the zero growth rate of social services, reaching 7.2%. In particular, online sales of food, clothing and daily necessities grew faster, exceeding the zero growth rate of the society. This shows that the potential of online consumption is increasingly prominent, and online retail is playing an increasingly important role in promoting the development of the overall retail industry.

Review of e-commerce market: the homogeneity of e-commerce platform layout is obvious

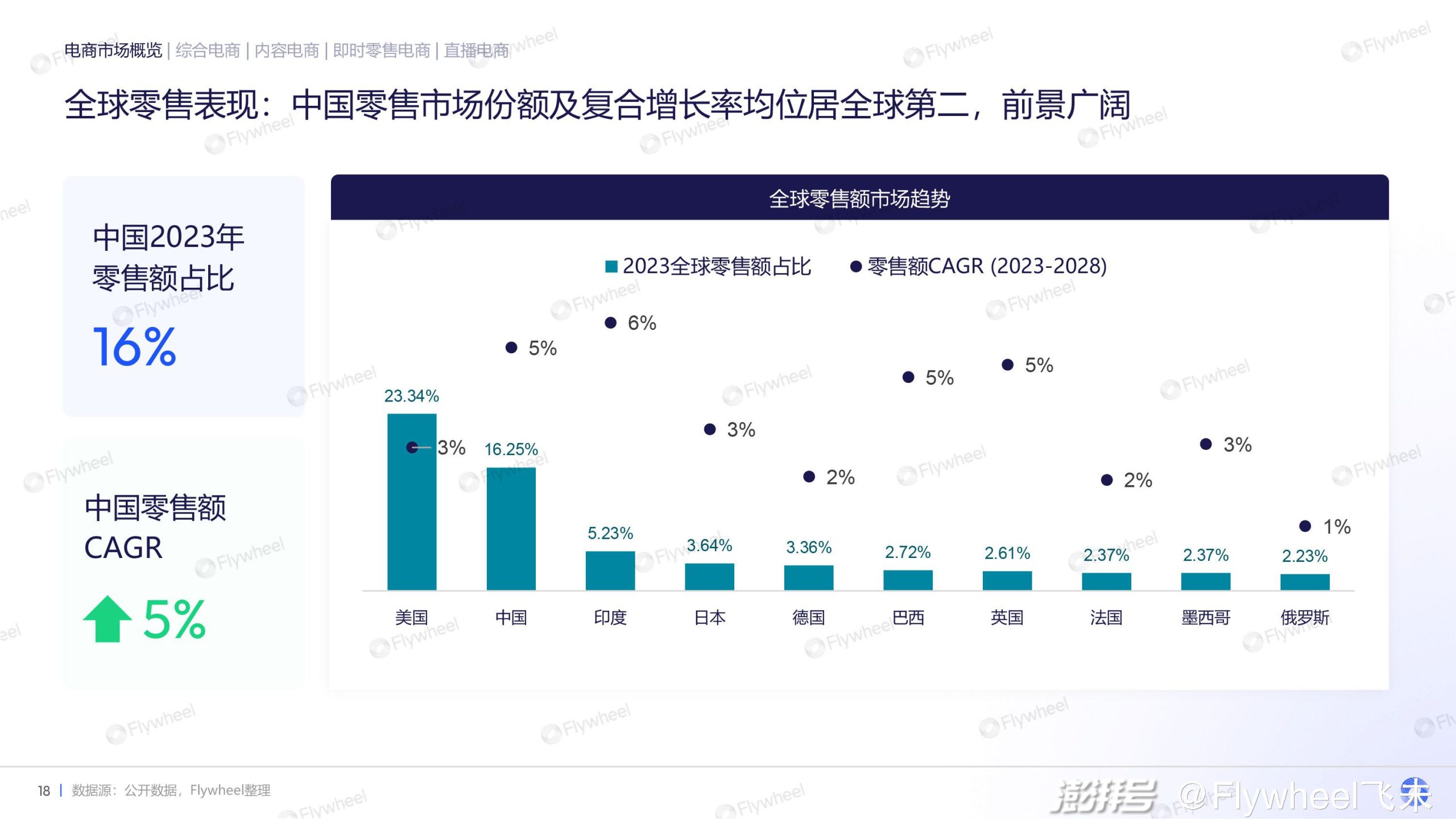

China’s retail market plays an important role in the world, not only ranking second in market share, but also showing a strong momentum in compound growth rate, second only to India.

The mainstream e-commerce has developed steadily, and traditional e-commerce platforms such as Tmall and JD.COM have maintained a steady development momentum. Pinduoduo started from the sinking market, and its market value once surpassed Ali, and the low-price strategy runs through.

Interest e-commerce has grown rapidly.As consumers spend more and more time on social media platforms such as Tik Tok, Aauto Quicker, WeChat and Xiaohongshu, major social media platforms have gradually strengthened the construction of e-commerce functions, providing users with personalized recommendation and social sharing shopping experience, leading the new wave of content e-commerce.

Instant retailing is another new growth engine.It combines the advantages of online shopping and offline physical stores, and meets the needs of consumers for convenient and fast shopping by means of rapid delivery and instant delivery. Platforms such as Meituan, Hungry, and JD.COM Home provide efficient instant retail services by establishing a strong logistics network and cooperating with merchants, which are favored by consumers.

Various forms of e-commerce provide consumers with more choices and convenience. The diversified development trend of e-commerce industry will continue to promote market competition, create a new consumption ecology, and further meet the diversified needs of consumers.

Driven by the current consumption boom, e-commerce platforms actively respond to market demand, introduce advanced technologies and innovative business models, adjust strategic layout in time, and continuously improve service quality, resulting in six major trends.

1. Platform height involution:Flat sales promote modernization and daily life. Through various measures such as official direct drop, 10 billion subsidies, support for small and medium-sized sellers, and traffic support, the platform has been involved in all aspects of price, content, service and logistics to improve its competitiveness.

2. Flow decentralization:The influence of super-head anchors has weakened, and e-commerce traffic has entered the era of decentralization. Traffic is distributed to middle waist and long tail anchors. Platform marketing, brand store broadcasting, and the rise of vertical talents.

3. Integrated development of the whole region:The content field and shelf field are integrated and developed. Shelf e-commerce vigorously develops the quantity and quality of short videos, pictures and texts in the ecology, and provides traffic inclination and independent entrance; Content e-commerce began to build shopping malls and optimize search.

4. The ecological break through:Different ecological circles continue to improve the closed-loop full link within their respective systems, and at the same time, they also begin to exchange needed goods. From the giants cutting land for kings, shielding each other from external chains to breaking down barriers to open up the ecology, tearing down walls brings greater opportunities and turning points.

5.AI empowers and improves efficiency:The advent of ChatGPT has accelerated the pace of the layout of AI on various platforms. From the research of large language model to the empowerment and efficiency operation of AIGC, AI has penetrated the industrial chain of e-commerce in all directions.

6. Plus local life:Online traffic growth has peaked, and under the consumer regression line, "eat, drink and be merry" that just needs high frequency has become a battleground for major e-commerce platforms. From the next day to 30 minutes, from group buying live broadcast to take-away live broadcast, the traffic era has ushered in a new way of playing local life.

In the integrated e-commerce platform, Alibaba Group has improved the strategic position of Taobao Tmall through structural split reform, and its strategic upgrade has achieved remarkable results, attaching importance to price power, strengthening content, emphasizing the value of merchants and users, and developing in the direction of AI-driven.

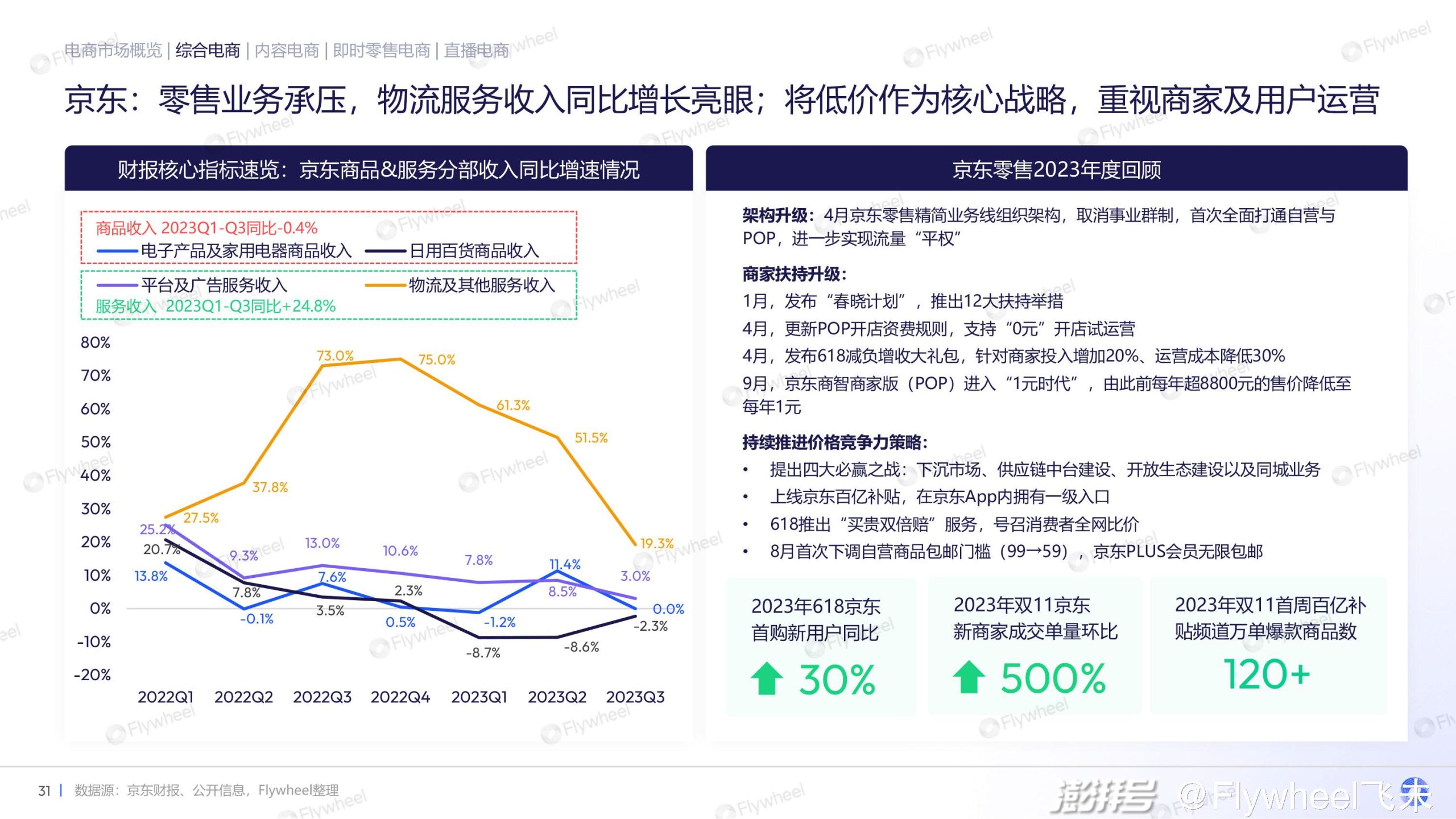

JD.COM is under pressure in the retail business, but its logistics service revenue is growing remarkably year-on-year. JD.COM also takes low price as its core strategy, and attaches importance to the operation of merchants and users.

During their stay in double 11, Taobao Tmall and JD.COM competed for the lowest price mentality, and continued to promote GMV. The scale of users, businesses and orders became new indicators of concern.In order to support businesses, the support and incentives provided by double 11 have been continuously enhanced. However, the popularity of social media in double 11 continues to decline, and consumers are more rational about the promotion activities. The trend of "leveling sales and promoting daily life" is becoming increasingly prominent.

Counting other e-commerce platforms also has a good development in 2023.

In content e-commerce, each major platform expands outward with the advantage of its own platform:

1. Tik Tok e-commerce:E-commerce in the whole region has developed rapidly. In 23 years, we have focused on building shelf e-commerce. The growth rate of GMV in Tik Tok Mall is higher than that of e-commerce as a whole, and it is gradually testing water for self-operation. Price concessions are the main tone and continue to attract consumers to form shopping habits in Tik Tok.

2. Pinduoduo:The scale of revenue continues to expand, and the sales expenditure continues to increase year-on-year, mainly due to the increase in consumer subsidies and the overseas expansion of TEMU; A solid mind of low price is still Pinduoduo’s killer.

3. Aauto Quicker e-commerce:Trust the market, the e-commerce dividend is obvious, pay attention to the healthy growth of merchants and talents, and build a global marketing scene of content+e-commerce.

4. Xiaohongshu E-commerce:Give full play to the advantages of planting grass in the content community, and promote the transaction transformation by taking notes with goods; E-commerce strategy turned to service talents and brands, plus live broadcast scenes, and built buyers’ eco-e-commerce.

5. Video number e-commerce:At present, the scale is small, still in its infancy, and the e-commerce scene is being improved; However, the huge monthly activity of WeChat and the rich content ecology of video numbers are the potential and dividends for developing e-commerce.

In the instant retail platform, major platforms actively provide various shopping modes to attract consumers to try new products:

1. Meituan:Strengthen content, launch short video function, explore diversified live broadcast forms, and build a pan-entertainment ecosystem. Increase the scale of flash purchase, expand the group purchase and distribution business, and optimize the user purchase experience.

2. Hungry:Merging with Gaode, we will open up the delivery route of Tik Tok live broadcast room, expand the contacts of commercial consumers, and continue to invest in instant e-commerce strategy.

3. When JD.COM gets home:Restart the front warehouse business, online convenience stores and community group buying business.

Tik Tok: Covering multiple cities and stores, strengthening the distribution capacity of local life service providers, and launching the Tik Tok supermarket and the independent entrance of Hours.

The live e-commerce platform is growing at a high speed, the integrated e-commerce platform increases the input of content, and the content e-commerce platform is differentiated according to the characteristics of customer groups:

1. Taobao Live:Mainly rely on the live broadcast of talent, rely heavily on the super-head anchor, and support the high-quality content anchor.

2. JD.COM Live:Create a self-operated live broadcast mode, the anchor is JD.COM Caixiao, and the main theme is "No pit fees, no commission for talents, it is cheaper".

3. Tik Tok Live:The live broadcast mode is mature, the segmentation rules are constantly improved, and the market is sunk with low prices.

4. Little Red Book Live:Rely on high-quality content and professional buyers to attract consumers who are willing to pay a premium for high quality.

Review of popular categories: consumers pay more attention to the total value of goods.

Different categories have different growth points in price, and there are contradictions in consumption patterns, but the root cause is the real psychological needs of consumers: consumers are willing to pay for some premium attributes, creating a small fortunate scene, resulting in consumption upgrading; With the upgrading of technology, high-end consumer goods are disenchanted, and consumers are also willing to accept the emergence of substitution, resulting in consumption degradation.

Consumer demand is in a dynamic change, and consumers pay more attention to the total value of goods, and the practical value and emotional value go hand in hand.

Through the rightFacial skin care, hair care, health, mother and baby, pet products, small household appliances, household cleaning, etc.By analyzing the categories, we find that most categories are growing again, the average price is rising, and the channels in Tik Tok are growing rapidly.

Among facial skin care products, the proportion of channels in Tik Tok jumped to the first place, and consumers increased their large consumption in Tik Tok. Travel clothes/experience clothes continue to grow at a high speed, which shows consumers’ prudent consumption attitude and also shows the continuation of short-term travel fever.

In the category of hair care, Tmall and Tik Tok account for a similar proportion of sales, and the average price is mostly declining. The replacement pens/hairline powder, dry cleaning spray/bitter fleabane powder are growing rapidly, and the demand for exquisite life is attracting attention.

Among the health products, the main channels are Tmall and JD.COM, and the average price of most head products has increased. The proportion of equipment products in Tmall and JD.COM is relatively large, and the head products in Tik Tok are all taken orally, so the demand for body building and influenza drugs continues.

Among the maternal and child categories, the main channels are Tmall and JD.COM, and the average price of most head categories has increased. Sub-categories have developed rapidly, and the requirements of functions and scenes are superimposed to create a new track.

Among pet products, Tmall’s sales in JD.COM account for 80%, but the sales in Tik Tok are higher than those in JD.COM. Under the price competition of various platforms, the average price reduction is a general trend. Most categories maintain positive growth, among which the sales scale of cat food is much higher than that of dog food, and the potential of pet medical care is worthy of attention.

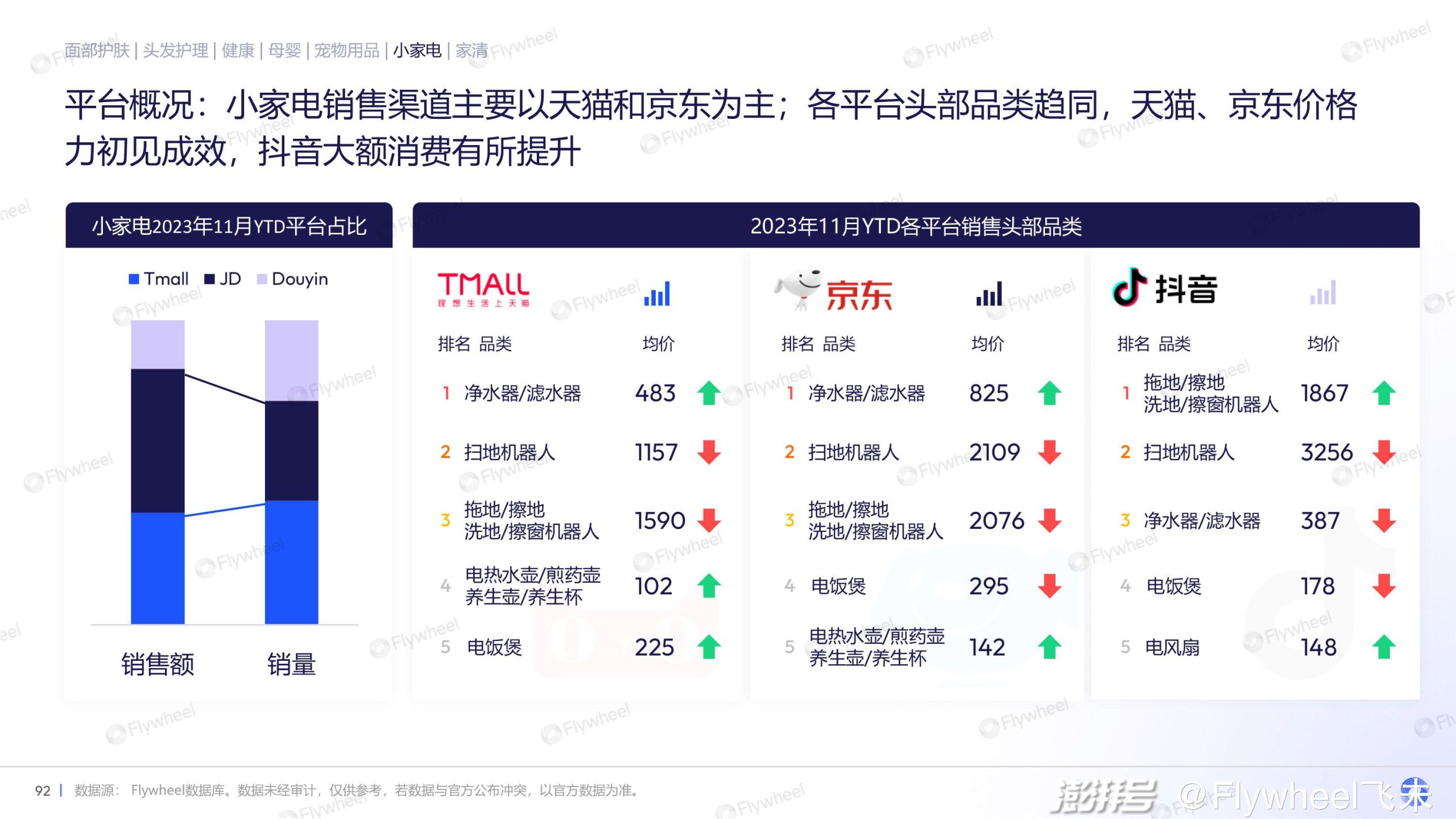

In the category of small household appliances, Tmall and JD.COM are the main sales channels. The head categories of all platforms converge, the price power of Tmall and JD.COM has achieved initial results, and the large-scale consumption of Tik Tok has improved. Household environmental cleaning appliances, water purification/drinking water appliances, drinks/desserts appliances have become star categories, and consumers’ demand for subdivided scene appliances is growing.

In the clothing care category, the sales volume of Tmall is similar to that of Tik Tok, but the sales volume of Tik Tok ranks first. Subcategories have developed rapidly, and the demand for sterilization and deodorization has temporarily dropped.

Among the related categories of paper products, Tmall and Tik Tok are the main sales platforms. Wet toilet paper, washcloth and other categories are worthy of attention, and the demand for paper related to kitchen and bathroom is paid attention to.

04 2024 Consumer Trend: Consumers are self-centered and attach importance to instant experience.

Consumers are more self-centered, attach importance to instant experience, pursue cost performance, and at the same time improve the quality of life, alleviate and cure the current pressure.

Give priority to me: self-demand becomes the first driving force of consumption. Pursue consumption with coexistence of quality and cost performance; Adhering to the concept of self-satisfaction, we are moving towards the "dopamine" model, which focuses on satisfying emotional values. Good looks, personality trends and social attributes are the main purchase motives.

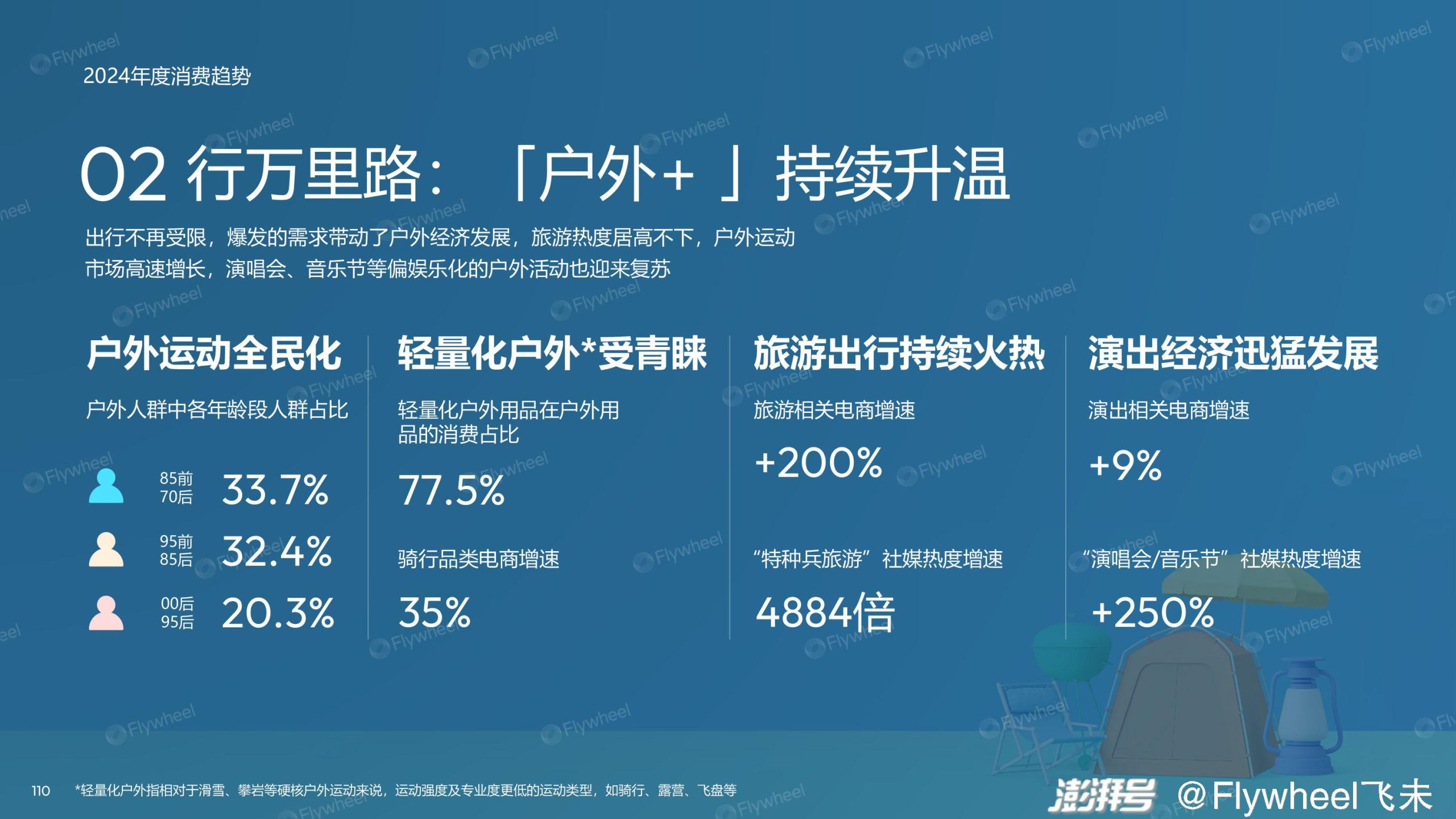

Wan Li Road: "Outdoor Plus" continues to heat up. Travel is no longer restricted, the explosive demand has driven the development of outdoor economy, the tourism fever remains high, the outdoor sports market is growing at a high speed, and entertainment outdoor activities such as concerts and music festivals are also welcoming recovery.

People and pets coexist: pets are anthropomorphic and consumption is fully upgraded. The number of pets is growing rapidly, and the consumption behavior around pets’ food, clothing, housing and transportation is gradually "anthropomorphic". The emotional value promotes the consumption will to be refined, customized and intelligent.

Proper health care: health management becomes a common topic. Infectious viruses such as COVID-19, A-stream and Mycoplasma are repeated. From panic medicine hoarding to orderly health management, health care has become the focus of people’s daily attention, and TCM health care continues to be hot.

The national tide is retro: the attention of domestic products returns to C. The once-silent national consumption field ushered in recovery, increased attention, a strong rise in sales performance, a new Chinese style with new elements, and the arrival of old brands in spring.

Interaction between reality and reality: the first year of AI started, and digital technology penetrated into life. The rise of ChatGPT announced that AI ushered in a new yuan and began to enter the homes of ordinary people. AI fitting, intelligent question and answer, digital anchor, virtual idol and AI content generation all ushered in a spurt of growth.