New progress in P2P platform supervision: the gradual differentiation of online loan filing platform has intensified.

The filing of P2P peer-to-peer lending platform, which has attracted much attention in the industry, has now ushered in new progress. It is reported that the regulatory authorities are soliciting opinions on the online loan filing rules. According to the current plan, some provinces and cities will be the pilot areas for filing. On the basis of summing up the pilot experience, according to the overall time limit of three years to prevent major risks, the filing and registration of stock online lending institutions will be completed nationwide in 2020.

In the eyes of many people in the industry, the introduction of online loan filing rules will be another major measure after compliance inspection and Opinions on Doing a Good Job in Classified Disposal and Risk Prevention of Online Loan Institutions, which is not only conducive to the follow-up filing work of the compliance platform, but also conducive to protecting the rights and interests of lenders and promoting the orderly clearing of industry risks.

Continuous adjustment of the industry

"The proposal of the online loan filing rules will promote the online loan industry to take a substantial step, which also means that the filing will be restarted in the near future. The acceleration of industry clearing and the filing of the compliance platform will obviously boost market confidence. " Zhang Yexia, dean of the Online Loan Home Research Institute, said.

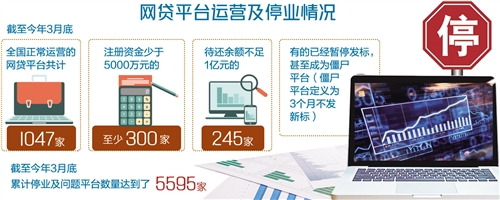

Since the Notice on Implementing the Interim Measures for the Management of Business Activities of Information Intermediaries in peer-to-peer lending in August 2016, it was first mentioned that the online loan industry implemented the filing and registration system, and the filing of the industry has been in an irregular state. Correspondingly, the prosperity of the online lending industry continues to decline, and problem events occur from time to time. According to the incomplete statistics of online loan houses, as of the end of March this year, the cumulative number of closed and problematic platforms reached 5,595; Recently, individual head platforms also broke out risk events, which once again brought considerable impact to the industry.

It is worth noting that according to the current plan, online lending institutions are required to pay "one book and two gold", of which "one book" refers to the paid-in registered capital; "Two funds" are the general risk reserve and the lender’s risk compensation. "This indicates to some extent the source of redemption funds after the outbreak of risk events by online lending institutions." Experts said that among them, the general risk reserve is used to pay in advance the losses caused by the online lending institution’s own reasons (such as publishing false information, failing to disclose information as required, and self-financing of online lending institutions). Lender’s risk compensation is used to make up the lender’s principal loss when the borrower has credit risk and cannot repay the lender’s funds as agreed.

"For most small and medium-sized platforms, this is a cruel knockout." Ai Yawen, an analyst at Rong 360 Big Data Research Institute, said that only this "one book and two gold" has blocked many small and medium-sized platforms with weak financial strength. In her view, in the face of the "cold winter" of the industry, financing channels and funds are shrinking, and it is also very difficult for the platform to introduce shareholder financing. In the first three months of this year, only one or two online lending institutions obtained venture capital funds.

Small platforms are not optimistic.

It is noteworthy that at present, the proposed plan proposes that online lending institutions can be divided into single provincial-level regional operation and national operation according to their business scope. In the future, a large number will be single provincial-level regional operation institutions, and regional operation institutions can only carry out fund matching services in this region. "This will undoubtedly significantly narrow the scope of risks, and the lending limit will further reduce lending losses." Wang chunying, a researcher at the online loan home research institute, said.

In the eyes of many people in the industry, the online loan filing rules will further aggravate the industry differentiation. For the national online lending institutions, it is not limited by the geographical location of lenders and borrowers, and its potential business scope is very wide; On the contrary, online lending institutions operating in a single provincial region can only match local funds to serve local borrowers, and the business volume and scope are greatly narrowed. The development prospect of national pilot institutions is much higher than that of regional institutions.

At the same time, Zhang Yexia said that the lenders and borrowers of new matchmaking business in the place where a single provincial-level regional operating institution operates must remain in the same provincial-level region as the place where the online lending institution is registered, which may trigger a wave of platform migration, only in the regional operation. The platform will reconsider the filing place.

In addition, for platforms that cannot complete filing, they can also guide institutions to transform into online small loans, consumer finance companies, or other licensed financial institutions. However, in Ai Yawen’s view, in addition to continuing to file for rectification, if the platform does not have absolute resource advantages, the transformation is of little significance. Small-scale online lending platforms with insufficient background strength are generally weak in operational capacity, poor in comprehensive anti-risk ability and not optimistic in profitability.

According to the key monitoring data of Rong 360 Data Research Institute, as of the end of March this year, there were 1,047 online lending platforms operating normally in China, with at least 300 registered funds less than 50 million yuan, and 245 outstanding ones less than 100 million yuan. Some of them have suspended bidding and even become "zombie platforms" (no new bidding will be issued for three months).

Strengthen investor protection

In order to better protect investors, according to the current plan, the number of creditor’s rights transfers between lenders of the same online lending platform shall not exceed three times, and creditors of different online lending platforms shall not transfer creditor’s rights; Online lending institutions shall not carry out automatic bidding and other entrusted bidding business; The lending balance of natural person lenders in the same online lending institution shall not exceed 200,000 yuan, and the total lending balance in different online lending institutions shall not exceed 500,000 yuan.

"This is to control the risk of online lending within a certain range and reduce the harm of risk events to lenders." Zhang Yexia said, but some detailed requirements need to be further explained. Take the lender’s identity authentication method as an example. For the online lending institutions operating in a single provincial region, the lenders and borrowers who have newly added matching business must remain at the same provincial level as the online lending institutions’ registration places, and the ways to confirm the lender’s identity need to be further clarified, such as referring to the ID number, the place where the mobile phone number belongs, and the login IP.

At the same time, in terms of the lender’s asset certification method, Zhang Yexia said that the asset certification needs to specify whether the lender needs to upload relevant certification materials and the form of certification materials, such as bank flow, income certificate, social security/provident fund payment record, and equity asset account balance. If uploading is needed, how to identify the authenticity of the certification materials by the platform is also a major problem for testing online lending institutions. At the same time, the issuance and uploading of certification materials may also cause poor lending experience of online lending platforms.

In addition, Sack Research Institute believes that under normal circumstances, the less investment, the weaker the risk tolerance of users. Online lending has high risks, so we should set a threshold for qualified investors and raise the initial investment limit.