CCTV News:According to the website of the Ministry of Human Resources and Social Security, recently, the general offices of the General Office of the Central Committee of the CPC and the State Council issued the Guiding Opinions on Promoting the Reform of Talent Evaluation Mechanism by Classification (hereinafter referred to as the Opinions). A few days ago, the relevant person in charge of the Ministry of Human Resources and Social Security interpreted the background significance, main contents and implementation of the Opinions.

Q: Please introduce the background and significance of the formulation and promulgation of the Opinions.

A: The CPC Central Committee and the State Council attached great importance to the reform of talents and talent evaluation mechanism. The 19th National Congress of the Communist Party of China put forward that talent is a strategic resource to realize national rejuvenation and win the initiative of international competition. We must adhere to the principle that the Party manages talents, gather talents from all over the world and use them to speed up the construction of a country with talents. General Secretary of the Supreme Leader stressed that it is necessary to improve the role of "baton" in talent evaluation and provide a broader world for talents to play their roles and display their talents. The Notice of the Central Committee of the Communist Party of China Municipality on Printing and Distributing Opinions on Deepening the Reform of Talent Development System and Mechanism clearly states that it is necessary to study and formulate guiding opinions on promoting the reform of talent evaluation mechanism by classification, and include them in the key tasks of the central government’s comprehensive deepening reform.

Talent evaluation is an important part of talent development system and mechanism, and it is the premise of talent resource development, management and use. For a long time, we have gradually explored and established a perfect talent evaluation mechanism, which has played an important role in discovering, cultivating, using and motivating talents. However, at present, there are still some problems in the talent evaluation mechanism, such as insufficient classified evaluation, single evaluation standard, convergence of evaluation methods, low degree of socialization of evaluation, and insufficient implementation of the autonomy of employing subjects. Especially, the practice of evaluating different talents with one ruler has attracted much attention from the society. The formulation of the Opinions is to accelerate the formation of a scientific socialized talent evaluation mechanism with clear orientation, precision, science, standardization and order, and competition for the best by deepening reform, breaking down ideological and institutional barriers, and promoting more and better growth of talents.

In order to implement the deployment requirements of the CPC Central Committee and the State Council, we set up a drafting leading group together with the Central Organization Department and other departments to conduct in-depth research, listen to opinions and suggestions from all sides, and organize relevant industry departments to conduct repeated research and demonstration. After the draft of "Opinions" was formed, it was submitted to the Central Talent Work Coordination Group and the Party’s Construction System Reform Special Group for deliberation. After it was submitted to the leading comrades of the State Council for examination and approval, The Politburo Standing Committee (PSC) conducted deliberation. The formulation and promulgation of the Opinions is an important measure to thoroughly implement the strategy of strengthening the country through talents and comprehensively deepen the reform of the system and mechanism of talent development. It will vigorously promote the reform of the talent evaluation mechanism, give full play to the positive incentive role of evaluation, and guide the vast number of talents to contribute their wisdom and wisdom to the Chinese dream of building a well-off society in an all-round way, winning the great victory of Socialism with Chinese characteristics in the new era and realizing the great rejuvenation of the Chinese nation.

Q: The establishment of a scientific evaluation mechanism has a clear guiding role in the growth and development of talents, and the whole society, especially the vast number of talents, are very concerned. Please introduce the overall consideration and main contents of the Opinions.

A: The Opinions fully implement the spirit of the 19th National Congress of the Communist Party of China, take Socialism with Chinese characteristics Thought of the Supreme Leader in the New Era as the guide, focus on the needs of economic and social development and talent development, follow the law of talent growth, highlight moral character, ability and performance orientation, and classify and construct evaluation mechanisms that reflect the characteristics of talents in different occupations, positions and levels. It is a comprehensive and guiding document for the reform of talent evaluation mechanism. In the process of formulating the Opinions, we pay attention to the following four aspects: First, adhere to the correct direction of reform. Implement the important thought of the Supreme Leader General Secretary on talent work and the overall plan of the Central Committee on deepening the reform of the system and mechanism of talent development, adhere to the principle of the party managing talents, follow the law of scientific evaluation, strengthen overall planning, and put forward overall, directional and principled requirements for reforming and improving the talent evaluation mechanism. The second is to adhere to the problem orientation. Focus on the key links and outstanding problems of the talent evaluation mechanism, identify the breakthrough points and breakthrough points, conduct in-depth research and demonstration, and put forward targeted reform ideas and methods, neither reinventing the wheel nor flooding. The third is to highlight key areas. On the basis of overall planning, the reform requirements of evaluation mechanism are put forward by classification, focusing on talents in science and technology, philosophy and social sciences, culture and art, education, medical and health care, technical skills and talents in enterprises, grass-roots frontline, youth and other industries. The fourth is to strengthen the connection and support. Grasp the positioning of the Opinions as a comprehensive and guiding document, and pay attention to connecting with the reform of individual talent evaluation system such as professional titles and professional qualifications.The Opinions mainly focus on the macro-mechanism reform such as evaluation criteria, evaluation methods, evaluation classification and evaluation management.

The Opinions are divided into five parts and 18 articles in total. The main contents include: the first part is the general requirements and basic principles; The second part classifies and improves the talent evaluation standards; The third part is to improve and innovate the talent evaluation method; The fourth part accelerates the reform of talent evaluation in key areas; The fifth part is to improve the talent evaluation management service system. Finally, it puts forward clear requirements for adhering to the principle of the party managing talents, strengthening the organization and leadership of talent evaluation, and paying close attention to the implementation of the work.

Q: Evaluation criteria are the core of talent evaluation and the most concerned issue in society. What are the specific measures of the Opinions in reforming and improving the talent evaluation standards?

A: The scientific evaluation of talents is first reflected in the evaluation criteria. The current talent evaluation standard lacks scientific classification, and there are some problems in measuring different types of talents with one ruler, such as emphasizing academic qualifications over ability, emphasizing qualifications over performance, emphasizing papers over contribution, and emphasizing quantity over quality. It has insufficient positive incentive effect on front-line innovative and entrepreneurial talents, and even leads to outstanding problems such as scientific research integrity, fraud and academic corruption. In order to evaluate talents scientifically, objectively and fairly and give full play to the role of evaluation baton, the Opinions put forward three key reform measures according to the principle of "what to do and what to evaluate". The first is to implement classified evaluation. On the basis of professional attributes and job requirements, establish and improve scientific and reasonable talent evaluation standards covering moral character, knowledge, ability, performance and contribution. The second is to highlight moral evaluation. Adhere to having both ability and political integrity, strengthen the evaluation of scientific spirit, professional ethics and professional ethics, and improve the integrity system of talent evaluation. The third is to pay attention to evaluating talents by ability, performance and contribution. Overcome the tendency of focusing only on academic qualifications, qualifications and papers, rationally set and use evaluation indicators such as papers, solve the problem of "one size fits all" evaluation criteria, and carry out differentiated evaluation of different talents.

Q: The evaluation method is an important part of the talent evaluation mechanism. What specific measures did the Opinions put forward to improve the evaluation method of innovative talents?

A: With clear evaluation criteria, we must adopt scientific and standardized evaluation methods to achieve accurate evaluation of talents. In view of the outstanding problems such as the single subject of talent evaluation, the weak professionalism of evaluation, the convergence of evaluation methods, the poor channels of talent evaluation in non-public fields, and the excessive and complicated evaluation activities, the Opinions put forward: First, establish an industry evaluation mechanism based on peer evaluation, and give play to the roles of multiple subjects such as market and society in talent evaluation of basic research, applied research and philosophy and social sciences. The second is to enrich the means of talent evaluation, combine the characteristics of different talents, and adopt different evaluation methods scientifically and flexibly. The third is to break the restrictions on household registration, region, ownership, identity and personnel relations, and smooth the channels for talent application and evaluation in non-public economic organizations, social organizations and emerging occupations. We will improve the methods for reporting and participating in the evaluation of the introduction of overseas high-level talents and foreign talents. Fourth, follow the law of talent growth and development, scientifically set the evaluation and assessment cycle, explore the implementation of the employment evaluation system, and appropriately extend the evaluation and assessment cycle for basic research talents and young talents. Fifth, deepen the reform of project evaluation, talent evaluation and institutional evaluation, streamline the number of evaluations, simplify evaluation links, improve evaluation methods, strengthen the sharing of results, and support talents to concentrate on research and long-term accumulation.

Q: There are a large number of talents in China, which are widely distributed in all fields of economic and social development. What are the requirements for the reform of talent evaluation mechanism in the Opinions?

A: There are specialties in the industry. With the rapid development of China’s economy and society, the continuous growth of talent team and the continuous refinement of social division of labor, it is imperative to evaluate talents accurately and objectively and implement classified evaluation. On the basis of putting forward the general requirements for the reform of talent evaluation mechanism, the Opinions focus on the deployment of talent evaluation mechanism reform in the fields of science and technology, philosophy and social sciences, culture and art, education, medical care and technical skills. There are three main considerations: First, the 19th National Congress of the Communist Party of China emphasized the need to cultivate a large number of strategic scientific and technological talents, leading scientific and technological talents, young scientific and technological talents and high-level innovative teams with international standards, and made important arrangements for strengthening the construction of skills, education, medical and health care and literary talents. The General Secretary of the Supreme Leader has repeatedly stressed the need to cultivate a talent team that meets the requirements of innovation and development, and put forward clear requirements for training and using the above-mentioned talents on different occasions. Second, judging from the reality of China’s talent team, these fields have a large number of talents, strong professionalism and representativeness, and are the main part of China’s talent team and an important backbone to promote economic and social development. The third is to clarify the core elements of talent evaluation in the above-mentioned key areas through classification and stratification, and establish an evaluation mechanism that conforms to the growth laws and actual characteristics of different talents. For academic requirements such as applied and practical talents, the achievements of innovation and entrepreneurship should be included in the evaluation criteria; Implementing the representative evaluation system, focusing on the quality of the results and diluting the quantity requirements; We will increase our efforts to tilt towards enterprises, grassroots frontline and young talents.Encourage and support researchers to devote themselves to research, teachers to the podium, doctors to the clinic, engineers to laboratories and factory sites, and agricultural technicians to the fields, and make contributions in different positions, so that people who do well can really be evaluated.

Q: To establish a scientific and socialized talent evaluation mechanism, it is necessary to play the role of multiple evaluation subjects such as the government, the market, professional organizations and employers. What reform measures are proposed in the Opinions?

A: Focusing on making the market play a decisive role in the allocation of human resources and giving full play to the role of the government, preventing the tendency of administrative and "official-oriented" talent evaluation, ensuring the implementation of the autonomy of employers, giving full play to the role of multiple evaluation subjects such as the government, the market and professional organizations, and forming a dynamic talent evaluation management and operation mechanism, the Opinions clarify the following reform measures: First, establish a talent evaluation management system with clear rights and responsibilities, scientific management, coordination and high efficiency, and promote the transformation of functions of talent management departments. Second, respect the leading role of employers, reasonably define and decentralize the authority of talent evaluation, promote qualified universities, research institutes and other enterprises and institutions to carry out evaluation independently, promote the organic connection between talent evaluation and training, use and encouragement, and maximize the evaluation efficiency. The third is to improve the socialized market-oriented management service system, actively cultivate and develop social organizations and professional institutions for talent evaluation, and orderly undertake the government’s talent evaluation functions. At the same time, in order to strengthen post-event supervision and improve the quality and credibility of talent evaluation, the Opinions put forward a number of regulatory measures, mainly including: strengthening the macro-management of government talent evaluation, formulating policies and regulations, public services, supervision and guarantee, strictly standardizing evaluation procedures and systems such as declaration, publicity and appeal, establishing a random and withdrawal evaluation expert selection mechanism, improving the integrity system of talent evaluation, strengthening the supervision of independent evaluation of employers, and establishing comprehensive evaluation and appeal of evaluation institutions.Clean up and standardize all kinds of talent evaluation activities and matters according to law.

Q: The reform of talent evaluation mechanism is a systematic project with many difficulties and heavy tasks. What are the specific arrangements for implementing the Opinions?

A: The talent evaluation mechanism is the key link of the talent development system. The front is connected with talent training, followed by talent use. The reform is systematic and policy-oriented, involving a wide range, and the society is highly concerned. As an important guiding document for the reform of the talent evaluation mechanism, the Opinions require all localities and departments to adhere to the principle of party management of talents, strengthen the unified leadership of party committees and governments, and cooperate with relevant departments to earnestly organize and implement them. The first is to formulate supporting policies by classification. The Ministry of Human Resources and Social Security will work with relevant parties to study and formulate the task division plan of the Opinions, compact the main responsibility of industry sector reform, and classify and formulate supporting policies for the reform of talent evaluation mechanism in the fields of science and technology, philosophy and social sciences, culture and art, education, medical care and technical skills. The second is to promote the reform task. The Ministry of Human Resources and Social Security will guide all regions to put the important guiding ideology and key reform measures of the Opinions into practice in promoting the reform of the talent evaluation mechanism. The third is to strengthen publicity and interpretation. Through various forms of publicity and reporting activities, strengthen policy interpretation and public opinion guidance, sum up typical experience of publicity and promotion in time, actively respond to social concerns, and create a good atmosphere and social environment for reform. The fourth is to strengthen supervision and inspection. The Ministry of Human Resources and Social Security will keep track of the progress of the implementation of the Opinions by relevant departments in various regions, strengthen classified guidance, and conduct supervision and inspection in a timely manner to ensure that the reform tasks are effective.

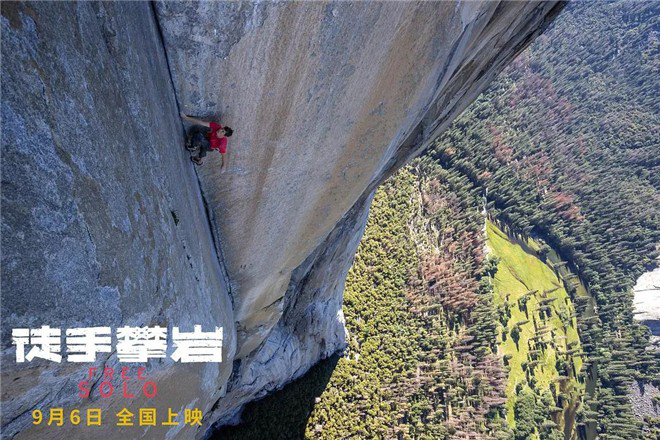

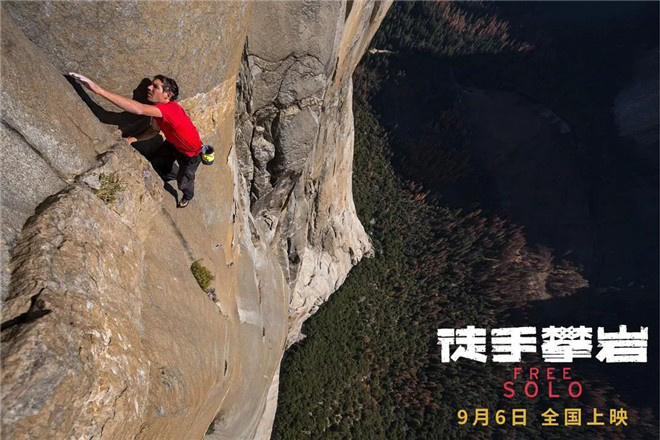

Classic extreme sports movie "Vertical Limit"

Classic extreme sports movie "Vertical Limit"

Extremist surfer

Extremist surfer