[Expert opinion]

Digital productivity is an important manifestation of new quality productivity (Xinhua News Agency & Sichuan Daily)

During his recent inspection tour in Heilongjiang, General Secretary of the Supreme Leader pointed out that integrating scientific and technological innovation resources will lead the development of strategic emerging industries and future industries and accelerate the formation of new quality productivity. At the symposium on promoting the comprehensive revitalization of Northeast China in the new era held on September 7, the General Secretary once again pointed out that "we should actively cultivate strategic emerging industries such as new energy, new materials, advanced manufacturing and electronic information, actively cultivate future industries, accelerate the formation of new quality productivity, and enhance the development of new kinetic energy."

Jiang Yongmu, Dean and Professor of School of Economics, Sichuan University, and Ma Wenwu, Associate Professor of School of Marxism, recently published an article "What is the new quality productivity? Where is the new one? It is pointed out that new quality productivity exists relative to old quality productivity, and the current manifestations of new quality productivity include digital productivity, green productivity and blue productivity.

"Digital productivity" refers to the ability to integrate other factors of production through digital technology, create material products and spiritual products that meet social needs, and promote national economic growth. It is the digital result of the trinity of productivity factors, namely workers, labor materials and labor objects. The General Secretary of the Supreme Leader attaches great importance to the development of digital productivity, and profoundly points out that technologies such as Internet, big data, cloud computing, artificial intelligence and blockchain are accelerating innovation, and are increasingly integrated into the whole process of economic and social development. Countries are competing to formulate digital economy development strategies and introduce incentive policies. The digital economy is developing at an unprecedented speed, with a wide range of radiation and unprecedented influence. It is becoming a key force to reorganize global factor resources, reshape the global economic structure and change the global competition pattern. This important exposition fully shows that "digital productivity" has a profound impact on economic and social development and plays a great role.

In the face of fierce international competition, China should seize the opportunity, speed up the construction of digital China, enhance "digital productivity", actively promote the formation of new quality productivity, and realize the iterative upgrading and leap-forward development of China’s productivity. We should seize the opportunity of digital development, strengthen the innovative application of key digital technologies, activate the potential of data elements, accelerate the construction of digital economy, digital society and digital government, and drive the transformation of production mode, lifestyle and governance mode with digitalization. Specifically, we should achieve "three passes": transform China’s traditional industries through "industrial digitalization" to make traditional industries form new productive forces; Create new market products, new industrial formats and new business models through "digital industrialization"; Empower social and economic development from a more basic level through "digital governance", and open up the blocking points of production, circulation, exchange and consumption, so that economic and social development is more smooth and convenient.

The key to moving from a digital power to a digital power (People’s Forum Network)

Liu Xiaoxin, director of the Virtual Economy and Management Research Center of Nankai University and professor of the School of Economics, recently published an article in the People’s Forum entitled "The Key to Moving from a Digital Power to a Digital Power". The article points out that China’s digital economy has achieved remarkable results. The digital economy has helped people to live a better life, injected vitality into the real economy, built a new financial ecology, and promoted the modernization of governance capacity. At the same time, the article points out that there are still many problems in the construction of digital economy system and mechanism in China.

One isThe data information management standard is not perfect. Although the reuse of data is economically efficient, the privacy and security problems caused by it are increasingly prominent. As the producer of data, individuals can not only get the ownership of data, but also face the risk of data leakage and abuse. As data collectors, large platform companies usually hoard data to improve the threshold of industry access and limit industry competition. The confirmation, pricing and circulation of data need to be market-oriented, but it is also inseparable from the government’s standardized supervision of its development. Personal privacy needs to be protected, and at the same time, it needs to allow individuals to voluntarily transfer their privacy. Therefore, we must first clarify the ownership of personal data, so that individuals have the right to decide where their privacy is used. However, the current legal rules lack a solid theoretical foundation and practical experience in dealing with data competition. The degree of restriction of data monopoly on market competition is relatively hidden, and it is difficult to measure the decrease of market efficiency and the loss of consumer welfare caused by it.

The second isThe digital transformation mode is not perfect. Digital technology is only the starting point. To realize the digital transformation of enterprises, it is necessary to start from the demand of digital transformation of enterprises and analyze the difficulties and pain points in the process of business transformation. The digital transformation of enterprises requires efforts in management and operation, which can greatly improve the efficiency of production and sales. The government needs to pay attention to the importance of providing relevant services and provide more support for economic entities. In addition, attention should be paid to bridging the digital divide in the process of digital transformation. Due to the different contact and use of digital technology between different regions and groups, some regions and groups are in a weak position in the development of digital economy, and their economic benefits are low.

The third isThe development path of digital finance is not clear. In the national and local policies on digital economy, most of them focus on digital infrastructure and digital industry. The development path of digital finance and technology and finance in digital economy needs to be further clarified. Digital finance is inclusive, which can improve the income of residents in backward areas and promote inclusive economic growth. At the same time, digital finance has also brought some adverse effects to the development of digital economy. Financial fraud, unlicensed practice and the barbaric growth of financial technology companies are common occurrences. The essence of finance is to serve the real economy. In the era of digital economy, digital finance needs to give back to the real industry with higher quality financial services, and use scarce financial resources to promote the development of digital technology and the digital transformation of industries. The development of digital finance needs encouragement, and correct innovation can improve its operation efficiency; The development of digital finance also needs to be standardized, and government supervision can correct the bad tendency of digital finance that is purely profit-seeking. The government should attach importance to the position of digital finance in the development of digital economy, and plan and guide the development path of digital finance.

The fourth isThe traditional statistical accounting system is not applicable. Many countries and international organizations have made a lot of explorations on digital economy accounting, but there is no consistent standard on the scope, classification and accounting methods of digital economy, and the accounting results obtained by various institutions are significantly different. In the future, with the further penetration of the digital economy into the traditional economy, all production and life will contain digital components, and how to accurately calculate the digital economy will be a major issue facing our country. At present, the accounting system of China’s digital economy focuses on the industrial perspective, which is easy to fall into the blind area of "only output value theory". It is difficult to accurately measure the inclusive application of digital technology in life, the construction of digital ecological environment and the innovation and breakthrough of digital technology under the current accounting system. In addition, when accounting for the digital industry, it is more difficult to account for the digital part of the industry compared with the digital industrialization part because it needs to separate the digital components from the traditional economic activities. Generally speaking, the accounting system of digital economy is far from meeting the requirements of the development of digital economy, and it is urgent to build an accounting system with China’s practical characteristics and suitable for international comparison.

This paper puts forward four suggestions on how to build a good digital economy system and mechanism.

First, integrate the administrative planning of digital economy.Set up a full-time organization for the development of digital economy to promote the synergy of various departments. As the focus of China’s development, the digital economy has not yet formed a full-time organization at the national level to take charge of overall command and coordination. Some local governments have taken the lead in making innovations in the form of digital economy administration. In Zhejiang Province, a Digital Economy Department has been set up under the Department of Economy and Information Technology to realize the overall leadership of digital economy development in the province. The digital economy covers many fields, such as science and technology, industry and people’s livelihood. The optimization and innovation of the administrative form of the digital economy will better integrate various administrative forces, improve the efficiency of policy formulation and implementation, give full play to the role of administrative forces in cultivating and supporting the digital economy, integrate the development planning of the digital economy in many fields, and realize the "multi-regulation integration" of digital economy planning. The development planning of digital economy in many fields, such as economic construction planning, urban and rural development planning, land use planning, industrial layout planning, etc., should be embodied in a development blueprint. In recent years, most provincial administrative regions in China have made development plans for digital economy, but their emphases are different. Decentralized planning is difficult to reflect the centralized will of the government. Therefore, the state should take the lead in the integration of digital economy planning and promote the orderly development of digital economy planning and integration.

Second, safeguard the rights and interests of citizens in the digital economy.China passed the Data Security Law of People’s Republic of China (PRC) on June 10th, 2021, and the Personal Information Protection Law of People’s Republic of China (PRC) on August 20th, 2021, which restrained the infringement of citizens’ rights and interests in the digital economy from the legal level. However, the development of digital economy is changing with each passing day. Under the influence of the profit-seeking and blindness of capital, the infringement of consumers’ rights and interests in digital industry will become more and more serious, and the infringement of citizens’ rights such as algorithm manipulation, data killing and privacy trading will be more hidden. Therefore, compared with the perfection of laws and regulations, it is more important to update and adapt the regulatory means and regulatory concepts for the digital economy where new things emerge one after another. To grasp the strength of supervision, we should pay equal attention to management and release, intervene and regulate moderately on the premise of cultivating fertile soil for the growth of digital economy, and prevent the digital economy from damaging citizens’ rights and interests.

Third, guard against the systemic risks of digital finance.The development of digital finance is a double-edged sword. On the one hand, digital finance has played a positive role in the development of the real economy and the improvement of people’s lives; On the other hand, because of its extensive coverage, the speed and scale of risk contagion far exceed that of traditional finance, which brings new challenges to national financial supervision. Digital finance lowers the entry threshold of the financial market, stimulates the disorderly expansion of various Internet finance enterprises, and attracts a large number of enterprises and individuals to engage in speculative activities, which increases the systemic risk of the financial market. Profits from digital finance should be based on the development of the real economy, and its profit rate should be normal. Excessive profit rate is not conducive to the growth of the real economy and is also unsustainable. China’s supervision of digital finance and technology and finance fully shows that its supervision of emerging things is maturing, and the central government and relevant departments have made timely adjustments to policies, encouraged innovation, and tried first. The regulatory authorities also played a key role in the relaxed regulatory environment in the early days of the network economy. On the one hand, encourage innovation and increase support for technological innovation and industrial innovation; On the other hand, in terms of system, regulations and supervision, the gradual policy adjustment is implemented, which is loose in the early stage, moderate in the middle stage and strict in the mature stage, which not only promotes the development of online payment, but also makes China’s online financial activities gradually enter a stable and orderly development track. In the future, the regulatory authorities need to conduct full coverage supervision of financial activities and unify supervision of digital financial companies. At the same time, the regulatory authorities can also use technology to improve their regulatory capabilities and implement accurate monitoring and control of financial risks. Anyway,On the premise of ensuring financial security, the regulatory authorities should still encourage financial innovation and support the development of digital finance.

Fourth, participate in global digital governance.From a global perspective, digital governance has become the main direction of government transformation around the world. Establishing a digital government with citizen participation as the core is the inherent requirement of the development of the digital economy era. However, due to the differences in digital governance demands and consensus among countries, it is difficult to establish an effective and unified global digital governance system. The establishment of global digital governance rules system should be the result of cooperation and multilateral consultation among countries, and should not be formulated by developed countries alone, but should be combined with the actual requirements of developing countries. As the largest developing country, China has the responsibility and obligation to participate in the co-construction of the global digital governance system and contribute to the world’s digital governance programs, such as the formulation of international rules for digital economy and cyberspace, the reconstruction of digital currency and the financial system. China’s active participation in global digital governance is a necessary way to promote the construction of a mutually beneficial and win-win international system. Effective and unified global digital governance takes the community of human destiny as the core concept and takes into account the interests of all countries in the world. Therefore, China should give full play to the positive role of digital economy in building a community of human destiny and make contributions to the common progress of all human society.

【 A number of merchants prosper agriculture and celebrate a bumper harvest 】

The activity of "2023 Prospering Agriculture by Counting Merchants and Celebrating Harvest" was launched (Ministry of Commerce)

In order to thoroughly implement the decision-making arrangements of the CPC Central Committee and the State Council, and in accordance with the "Golden September and Silver 10" work arrangement of the Ministry of Commerce to promote consumption, the "2023" activity guided by the E-commerce Department was officially launched on September 23, and will last for one month until October 22.

The activities were combined with the celebration of China Farmers Harvest Festival, which helped farmers to have a bumper harvest and enriched and promoted the consumption of urban and rural residents. Relying on the China E-commerce Rural Revitalization Alliance, e-commerce platforms and enterprises were widely guided to participate. Twenty-three alliance members launched 38 promotion measures, covering production and marketing docking, business assistance, personnel training, information services, publicity and promotion, including opening special online consumption zones such as soybeans and staple foods. Special activities such as agricultural specialty shopping festival, origin tracing, fresh picking, "promoting agriculture by several merchants" and brand innovation of "consumption+local products" were launched, and promotions such as "live broadcast+origin", "live broadcast+industrial belt" and "live broadcast+landmark" were carried out, covering more than 100,000 products.

As an important measure of business service for rural revitalization, the work of "Boosting Agriculture with Several Businessmen" focuses on key tasks such as brand building of agricultural products network, talent training and new infrastructure development. It has carried out local activities of "Boosting Agriculture with Several Businessmen" in 13 provinces and cities, which has helped docking sales to exceed 2.3 billion yuan, and promoted a series of cooperation in product procurement, industrial belt cooperation, entrepreneurship and employment. More than 3,000 enterprises benefited from the "three products and one standard" certification and passed the China e-commerce rural project.

Various e-commerce platforms have taken many measures to help agricultural products "go out of the village and enter the city" (China Business Daily)

On the occasion of the sixth China Farmers’ Harvest Festival, colorful activities to promote consumption were carried out all over the country. The major e-commerce platforms actively responded to the call and held various marketing activities to help agricultural products "go out of the village and enter the city".

Subsidies and low prices are still one of the main themes of the e-commerce platform Harvest Festival promotion activities. For example, JD.COM held a shopping festival for agricultural specialties, and through the implementation of "10 billion subsidies", it supported a number of high-quality agricultural specialties to reduce prices and improve service experience, and helped a large number of high-quality agricultural specialties from more than 2,000 industrial belts across the country to reach consumers’ tables and help farmers increase their income by selling goods. Millions of merchants in Meituan’s linkage platform have set up online special pages to promote consumption through Meituan’s optimization, Meituan’s grocery shopping and Meituan’s flash shopping, and invested tens of millions of subsidies to make high-quality specialty agricultural products from all over the country sell well through online platforms. Pinduoduo launched the "Duoduo Harvest Pavilion", invested 1 billion yuan in resource packages, and joined forces with 300,000 agriculture-related businesses and over 1,000 agricultural producing areas across the country to promote the quality improvement and efficiency improvement of agricultural products industrial belts.

In addition to exerting strength at the sales end, the e-commerce platform also extends its tentacles to the production end. The e-commerce platform opens the source of direct mining, reduces the intermediate circulation of goods, ensures the quality of goods and the traceability of the supply chain, and provides consumers with more secure products. JD.COM Jiama agricultural special products’ source direct-sending mode, relying on JD.COM’s efficient digital and intelligent supply chain, goes deep into the origin, allowing high-quality agricultural special products to reach the table directly from the origin. It also cooperates with local governments and associations to reduce procurement costs through large-scale direct procurement at the source. Meituan buys vegetables through the "local sharp goods" plan, and completes the whole link of production and marketing in one day through traffic support, bulk purchase and direct source purchase in many places, improving the efficiency of the supply chain.

Taobao Tmall sells more than 1 trillion agricultural products in 4 years (China Economic Weekly)

Recently, Taotian Group released data showing that in the past four years, the sales of agricultural products on Taobao Tmall platform exceeded 1 trillion yuan. During this year’s Harvest Festival, Taobao Tmall went deep into the country of origin, invested billions of traffic support, and broadcast live in more than 130 industrial belts, covering more than one million agricultural products, helping more agricultural products out of the mountains. The data shows that from 2023 to now, Pu ‘er, rice, beef, ready-to-eat bird’s nest and sausage rank in the top five in the sales of agricultural products in Taobao; Broccoli, donkey-hide gelatin paste, cherries and watermelon have the fastest growth rate; Consumers in Guangdong, Zhejiang and Jiangsu prefer to buy agricultural products in Taobao. In addition, Taotian Group and Intellectual Property Publishing House signed a strategic cooperation framework agreement and launched the action plan of "Landmark Line-Prosperity of Geographical Indication Brand" to support and promote more than 2,000 geographical indication agricultural products approved by the state to join Taobao Tmall platform, providing all-round support for expanding online sales of geographical indication agricultural products.

JD.COM released the "Benfu Plan" for rural revitalization (China Net)

Recently, JD.COM officially released five major actions of "Ben Fu Plan" for rural revitalization. First, through brand building, help local agricultural special industries to speed up; The second is to accelerate the circulation of agricultural products through the sinking of infrastructure; The third is to accelerate the development of the whole industrial chain of digital intelligence by extending to the production end; The fourth is to speed up the modernization of rural governance through digital intelligence empowerment; Fifth, by strengthening personnel training, we will accelerate rural capacity building. In August, 2020, JD.COM launched the "Plan for Prosperity" for rural revitalization in an all-round way. As of June this year, the goal of "driving rural output value to exceed one trillion in three years" has been completed ahead of schedule, helping millions of farmers to increase their income and embark on the road of prosperity.

Tik Tok helped to sell 4.73 billion agricultural special products in one year (cover news)

Recently, Tik Tok E-commerce released the "Data Report on Tik Tok E-commerce Helping Agriculture in Harvest Festival 2023", which shows that from September 2022 to September 2023, Tik Tok E-commerce helped to sell 4.73 billion agricultural special products, with an average of 13 million parcels of agricultural special products sold all over the country every day. The number of short videos of agricultural special products sold by e-commerce trailers in Tik Tok was 21.86 million, and the total time of explaining agricultural special products in the live broadcast room was 37.78 million hours. The sales of agricultural special products driven by shelf scenes increased by 137% year-on-year. The number of experts in agriculture, rural areas and farmers increased by 105% year-on-year, the number of agricultural goods merchants increased by 83% year-on-year, and there were more than 24,000 agricultural goods merchants with annual sales exceeding one million yuan. In terms of age distribution, the post-90s consumers have become the main consumers of agricultural products in Tik Tok e-commerce, accounting for nearly 40% of the purchases. According to statistics, after 00 and 60, the purchase volume of group agricultural products increased by more than 150% year-on-year, making it a potential consumer.

The report of Renmin University pointed out that it is necessary to crack down on e-commerce "going to the countryside is easy to help agriculture" (Economic Observer)

A few days ago, the research group of the School of Agriculture and Rural Development of China Renmin University released the "Digital Intelligence Supply Chain Helps Rural Revitalization" (hereinafter referred to as the "Report"), which pointed out that most e-commerce enterprises actually present the dilemma of "going to the countryside is easy, but helping agriculture is difficult", and it is necessary to break through the constraints in mode and system to solve this problem.

Specifically, e-commerce companies have three major dilemmas: "It is easy to go to the countryside but difficult to help agriculture". First, market certainty decays in the process of upstream transmission. E-commerce companies can accurately measure the market demand according to the sales data, but this certain time period is not enough to cover the agricultural production cycle to help farmers (including large farmers) reduce market risks. Second, the spillover risk of circulation and production links is relatively high. Small and medium-sized producers directly and dispersedly enter the market circulation, and the institutional transaction cost makes it impossible for both parties to establish stable income expectations, and even shows an antagonistic relationship to some extent. The bidding procurement mechanism forces farmers to pass on costs to the ecological environment and consumers. Third, the high mobility of commodities increases food safety risks. "Hong merchants replace sitting merchants" and "virtual space replaces physical space" reduce the income share of wholesale and supermarket real estate in the circulation system, but it also increases the difficulty of food quality and safety supervision.

In view of this problem, the Report gives some suggestions and measures for e-commerce enterprises to go to the countryside with the case of JD.COM’s assistance to rural revitalization. First, the rural market in China has great potential. However, due to its geographical dispersion and relatively weak local logistics supply chain, many e-commerce companies are facing a series of challenges when entering the rural market. JD.COM’s logistics system, which focuses on asset investment and integrates warehousing and distribution, shows its unique competitive advantage. The second is to optimize intermediate links to help local governments obtain high returns. According to the market demand, JD.COM’s dispatching system will be adjusted quickly, and the scale of warehousing, wholesale and logistics at all levels will be deduced directly by using the data of the consumer side, which has made beneficial adjustments to the inherent industrial chain of traditional agriculture. Third, brand innovation activates local resources. JD.COM has realized the transformation from local low value-added industries to high value-added industries by brand building, and activated local resources.

[number-reality fusion]

Tencent report emphasizes the integration of number and reality to strengthen the resilience of industrial development from three aspects (Tencent Research Institute)

On September 26th, Tencent Cloud and Smart Industry Group released "Report on High-quality Development of Digital Economy in 2023" (hereinafter referred to as "Report"), pointing out that in the past five years, the "cloudization" of China’s industry was initially completed, the software and hardware infrastructure and ecology were self-contained, and the industry began to evolve into "intelligence". Digital technologies such as cloud computing, big data and artificial intelligence have been further integrated with industrial scenes, and the "resilience" of China’s industrial development has been continuously strengthened. The Report summarizes the development resilience of China’s industry as strengthening the impact resistance of the industrial chain, stimulating the endogenous growth of enterprises, releasing consumption vitality and enhancing social service capacity.

In the industrial chain, digital technology has brought new models and new forms. Take the garment industry chain as an example. As a part of the industry chain, Xunxing Zipper, a zipper manufacturer, integrates all links from customer’s orders to the circulation of production materials, inventory monitoring, production, quality inspection, logistics and distribution on enterprise WeChat, and opens up the cooperative chain of the whole industry chain. This quick-response industrial chain has successfully supported the "small order and quick return" mode of cross-border e-commerce in China, such as Shein and Temu, so that they can produce new styles of clothing in weeks or even days to meet the immediate needs of overseas users; However, the fresh cold chain industry has long been plagued by the high spoilage rate in the process of transshipment and circulation. Large meat, eggs and milk suppliers hope to use Tencent Cloud server to store data and connect outlets with Tencent Big Data to establish a nationwide smart logistics network, improve scheduling timeliness, reduce transportation costs, speed up inventory turnover, and create a new digital paradigm for the cold chain industry.

In the endogenous growth of enterprises, digital technology opens up the "aorta" and "capillary" of enterprise development, profoundly changes the production, operation and management methods of enterprises, and effectively stimulates the endogenous growth of enterprises. Fuchi Hi-Tech’s AI quality inspection scheme compresses the quality inspection completed in one minute to a few seconds, and the defect detection rate reaches 99.9%. The digital port built by China Merchants has realized "one-stop" customs declaration application, and the customs clearance efficiency has increased by 50%, which directly promoted the port’s year-on-year throughput growth by more than 6 times; Ruitai Masteel’s twin "transparent factory" with digital technology has improved the production efficiency by 30% and reduced the failure rate by 25%.

In terms of consumption vitality, digital technology further shortens the distance between enterprises and users and activates users’ willingness to consume. Baiguoyuan has built more than 12.9 million private community users through applets, WeChat and enterprise WeChat, and built a new marketing model: taking stores as drainage points and communities as private domain operating positions to build a user service network, opening up communities, applet malls and offline stores, integrating online and offline experiences, providing users with refined services and increasing sales. In 2022, Baiguoyuan was not only successfully listed, but also its revenue was close to 15 billion yuan.

Three Development Trends of Retail Digitization (Billion Power)

Recently, Billion Think Tank and Bojun Research Institute jointly released "Responding to Retail Performance Growth-Practice Report on Retail Digital Growth in 2023", focusing on how retail enterprises respond to performance growth through digitalization, and summing up three future development trends of retail enterprise digitalization in the stock era.

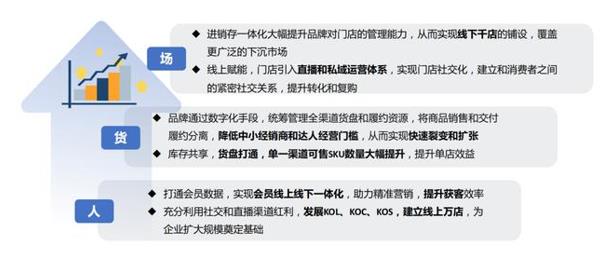

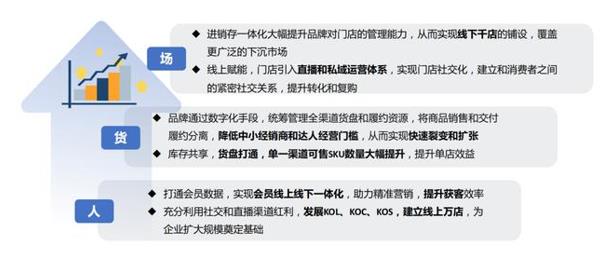

The first is to reconstruct all factors and achieve a brand of 100 billion. The retail organism reconstructs all the elements of people, goods and fields, and taps the incremental development of online and offline, which is the growth base for establishing a 100 billion brand.

From the online point of view, the retail organism separates the main body of commodity sales and delivery performance, lowers the operating threshold of small and medium-sized dealers and talents, enables brands to make full use of social and live channel dividends, develop key leaders, key opinion consumers and key opinion sales, and establish a trading model of online sales and brand overall performance, laying the foundation for enterprises to expand their scale. From the offline point of view, through inventory sharing and pallet opening, the brand can realize the integration of omni-channel purchase, sale and storage, and the number of SKUs that can be sold in a single channel has greatly increased, thus improving the efficiency of a single store. In addition, the integration of purchase, sale and storage greatly enhances the brand’s ability to manage stores, thus realizing the laying of thousands of offline stores and covering a wider sinking incremental market. From the perspective of members, the global membership data has been opened, and the brand marketing ability has been greatly improved. With omni-channel ordering and cross-channel performance, the brand can respond to consumers’ purchasing demands at any time, seize consumers’ fleeting purchasing desires, and achieve efficient transformation.

The second is to optimize the whole chain and build a retail organism. Retail organisms reshape the business chain, reconstruct the value chain, respond quickly, and deliver immediately as the basic ability. Profit distribution and immediate receipt are the "lubricants" of their operation. Manufacturing, omni-channel sales and omni-channel performance become an organic whole: sales promote reverse customization of production, and production information sharing improves performance efficiency; Omni-channel access provides more flexible purchase scenarios, and automatic account sharing/settlement enhances the willingness and efficiency of all parties in the industrial chain; Omni-channel quick response and quick delivery establish the operation base of online stores and offline stores to meet the timeliness requirements of consumers’ constantly improving commodity delivery.

The third is the global full-scenario operation and the value of data assets. Global full-scenario operation enables retail enterprises to accumulate rich data assets. The application of emerging technologies such as AIGC and Big Model in the fields of marketing and customer service will require large-scale data, and at the same time, more data will be generated. Driven by the policy, retail data needs to be confirmed, priced and traded, and the trend of data asset value has become clear. The digital department will undertake the growth of retail enterprise data assets, and its role will change from functional department to growth department.

Guolian Co., Ltd. deeply reconstructs the industrial supply chain through digital empowerment (Yibang Power)

The titanium industry chain starts from the original titanium-bearing ore, to the titanium middling, titanium concentrate and then to titanium tetrachloride. Guolian Co., Ltd. reconstructs the titanium industry supply chain by digitally empowering the cloud factory, and helps enterprises to improve their production capacity, save energy and increase income while realizing their high-speed growth, which makes the cloud factory devote more energy to technology research and development.

According to the development of titanium industrial chain, Guolian shares extend upstream and downstream after a single product breakthrough. Because the price of rutile contained in stone ore and titanium middling ore is much higher than that of titanium concentrate, Guolian shares locked in Zhongxing Electronics when looking for rutile customers. Initially, the cooperation between Zhongxing Electronics and Guolian Co., Ltd. was only a commodity transaction, that is, Guolian Co., Ltd. provided raw materials for Hongxing Electronics. In the process of cooperation, as they gradually understand each other’s technology and advantages, the two sides decided to cooperate deeply to digitally empower Zhongxing Electronics, and Zhongxing Electronics became the first digital cloud factory of Guolian in the titanium industry chain.

The mode of cooperation between the two parties is as follows: Guolian Co., Ltd. collects orders downstream and delivers them to Zhongxing Electronics, and Zhongxing Electronics formulates production plans in combination with its other customers’ needs, and then Tuduoduo Platform under Guolian Co., Ltd. provides raw materials as planned, and Zhongxing Electronics does not need to pay in advance for raw materials supply. The production cycle of the order is 6-8 hours. After shipment, it will be shipped directly by Tuduoduo, and the profit will be calculated every Monday, Wednesday and Friday. Guolian will pay the profit to Zhongxing Electronics first, and the two parties will settle the account in half a month, a month or even a quarter.

In the early days, Zhongxing Electronics purchased raw materials in the form of decentralized procurement. The backlog of raw materials in the factory warehouse could not be realized quickly, which increased the cost invisibly. The price of raw materials fluctuated greatly, and the supply of raw materials was difficult to meet when the price increased. After in-depth cooperation in the supply chain, all the core raw materials of Zhongxing Electronics, rutile and calcined coke, were purchased through Tuduo, which not only obtained more favorable prices, but also reduced the backlog of raw materials; At the same time, the proportion of products sold by Zhongxing Electronics to Guolian shares is above 90%, and only two people need to dock with Guolian shares in terms of purchasing and selling, saving labor costs.

After solving the problems of raw materials and cost, Zhongxing Electronics can put more energy into technology research and development. Zhongxing Electronics completed the technical innovation of chlorination method, and processed it with titanium raw materials containing 50% titanium, which was about 38% lower than the purity of the raw materials used before. Based on the final product titanium tetrachloride, the cost per ton was saved by about 2,000 yuan.

With the increasing demand for energy consumption and environmental protection in recent years, Guolian helped Zhongxing Electronics to carry out digital transformation, which enabled the factory to monitor the energy consumption of various equipment in real time and control the cost and operation efficiency, so that Zhongxing Electronics received energy subsidies in 2022 and 2023, and the subsidy amount in 2022 exceeded 400,000 yuan.

Through digital transformation, the capacity of cloud factories in the titanium industrial chain of Guolian Co., Ltd. has been improved. Mengda Titanium Industry upstream of Zhongxing Electronics produces high slag titanium, with an original production capacity of 4,000-5,000 tons and a full production capacity of 15,000 tons at present. Shengfeng Titanium Industry, which mainly produces sponge titanium in the downstream, originally had an annual production capacity of 4,000 tons, with an output value of about 280 million yuan. After the completion of the second phase plant, the annual production capacity will reach 18,000 tons, with an output value of about 1.2 billion yuan. All the furnaces in Shengfeng Titanium Industry use electronic equipment to obtain data, which reduces energy consumption and saves 100-150 kWh per ton of products.

Up to now, Guolian has signed 65 cloud factories and 27 digital factories. Guolian Co., Ltd. focuses on the upstream chain construction from titanium ore, high slag titanium to titanium tetrachloride and then to sponge titanium, and has provided digital supply chain and digital factory solutions for more than 10 production enterprises, realizing the synergy between the factories in the supply chain.

[Technology Frontier]

Gartner released five technologies that will profoundly change the digital future of enterprises (The Paper)

Recently, Gartner, an authoritative analyst in the IT industry, released five technologies that will profoundly change the future digitalization of enterprises, including digital people, satellite communication, micro-environment Internet of Things, secure computing and autonomous robots.

1. Satellite communication. Driven by the trend of democratization and commercialization in space, people’s interest in LEO satellite communication is increasing. Low time delay makes low earth orbit an important technology for enterprises to completely change the communication between people and things. Gartner predicts that low earth orbit will provide broadband with global coverage and low enough delay for various tasks; Small IOT devices can be directly connected to satellites, achieving economical global IOT coverage, without the complexity brought by SIM cards, telecom operators and roaming; And provide voice and data services from satellites to unmodified 4G smartphones, extending coverage to remote areas.

2. Micro-environment Internet of Things. Micro-environment Internet of Things can mark, track and sense any object, and avoid the complexity and cost brought by battery-powered equipment. Compared with the past, it can perceive more information and things "quietly" at lower cost and in more ways. This technology will promote the realization of a new ecology; A new business model based on understanding the position or behavior of objects; Smarter products with new behaviors; And lower tracking and monitoring costs. Micro-environment Internet of Things will bring more opportunities to many enterprises, but Gartner suggests evaluating its potential social and regulatory problems before adopting it.

3. Safety calculation. With the increasingly close relationship between things and the increasing personal information accessed by various ecosystems, secure computing becomes very important. This technology can make full use of data without affecting privacy.

4. Digital people. Digital people are interactive carriers driven by artificial intelligence (AI), which can imitate some characteristics, personalities, knowledge and ways of thinking of human beings. Digital people can be divided into physical digital people (such as humanoid robots) and virtual digital people (such as virtual singers), or into human-driven digital people (such as imitating some aspects of human beings) and AI-driven digital people (such as digital twins or chat robots). AI-driven digital people don’t need to be human in all respects.

5. Adaptive autonomous drones and robots. Autonomous systems are physical or software systems that can manage themselves. They have autonomy, learning and agency (personal sense of purpose) when performing tasks. If robots and other technologies are to give full play to their potential, autonomous learning and adaptive systems will be essential.

Baidu released the first large model of quantum field (Yangguang. com)

Recently, Baidu released the first large model of quantum field at the 2023 Quantum Industry Conference. Based on ERNIE Bot, this model is a large-scale model in quantum field, which is constructed by using high-quality data in quantum field for more targeted training and optimization. It can better understand quantum knowledge and perform quantum tasks professionally. The big model will give full play to technology synergies, learn from each other’s strengths in data, algorithm and computing power, and realize two-way empowerment. It will fully complement the technical capabilities of the existing big model in various dimensions such as training speed, model performance, training cost, interaction efficiency and data privacy. In addition, Baidu also released two AI native applications, Baidu Quantum Assistant and Quantum Writing Assistant, which continuously lowered the use threshold of Baidu quantum platform, helped enterprises to precipitate research results and intellectual property rights in the quantum field into enterprise assets, and accelerated the deep integration of quantum technology and large models.