In order to implement the relevant requirements of the CPC Central Committee on preventing and resolving major risks, according to the "the National People’s Congress Standing Committee (NPCSC) 2019 Annual Supervision Work Plan", this year, a special investigation on the budget management and reform of the basic old-age insurance fund was organized, and the Budget Working Committee of the Standing Committee was responsible for the specific implementation. Since March this year, the special research group composed of the Budget Working Committee has specially listened to the briefings of the Ministry of Finance, Ministry of Human Resources and Social Security, State Taxation Administration of The People’s Republic of China, Audit Office and other relevant departments in the State Council, and has successively conducted field research in Hubei, Liaoning, Jilin and other places, and held special symposiums to listen to the opinions and suggestions of some experts and scholars and some relevant working institutions of the Standing Committee of the Provincial People’s Congress to analyze and compare the endowment insurance system and reform in typical countries. The relevant situation is now reported as follows.

I. Basic information

The basic old-age insurance covers a wide range of people and has a large scale of fund income and expenditure. It is the most important type of social insurance and the most important part of the social security system. In recent years, governments at all levels and their relevant departments have conscientiously implemented the decision-making arrangements of the CPC Central Committee, persisted in promoting the construction of a multi-level social security system with full coverage, basic security and sustainability, constantly improved the fund budget preparation, strengthened the fund budget management, and promoted the deepening of the reform of the basic old-age insurance system, which provided strong support for weaving a social security network covering all people and grasping the basic livelihood bottom line.

(A) the basic old-age insurance system

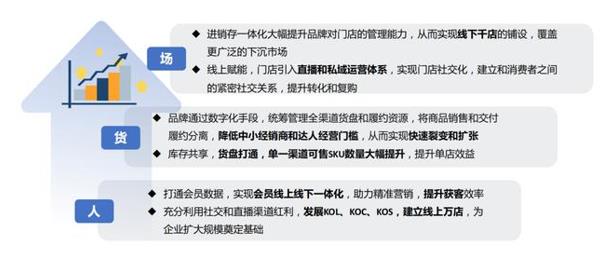

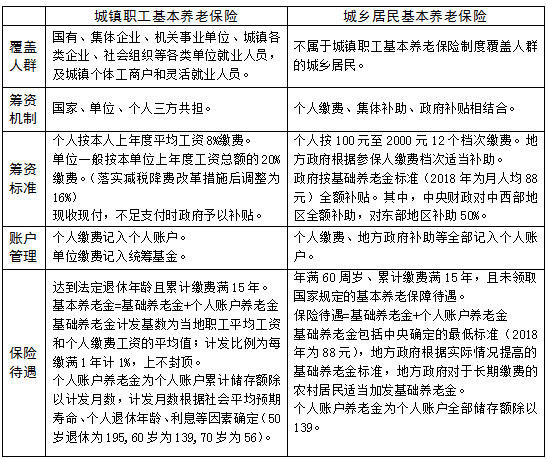

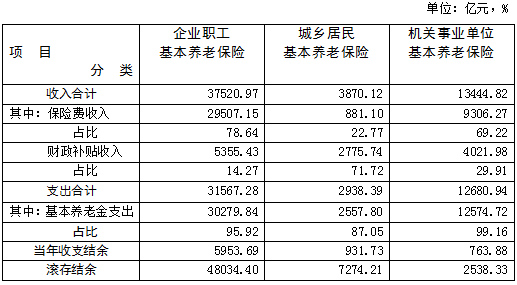

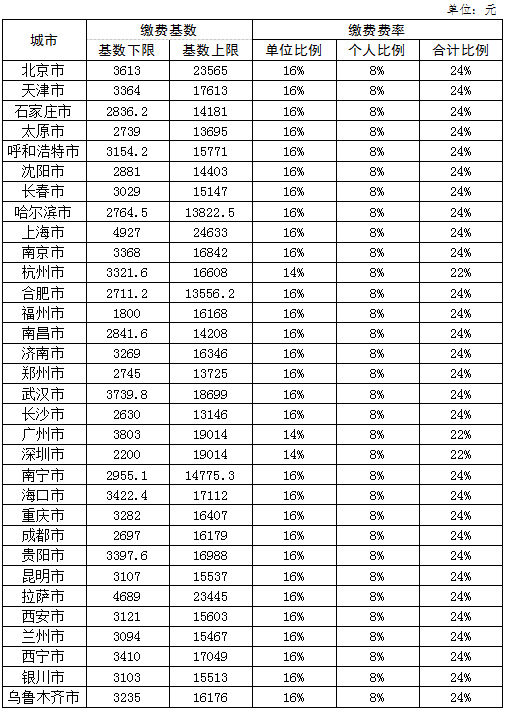

China’s basic old-age insurance consists of urban workers’ basic old-age insurance (enterprise workers’ basic old-age insurance, government institutions’ basic old-age insurance) and urban and rural residents’ basic old-age insurance (see table 1). According to the statistics of Ministry of Human Resources and Social Security, by the end of 2018, there were 943 million people participating in the basic old-age insurance nationwide. Among them, 419 million urban workers and 524 million urban and rural residents participated in the insurance.

Table 1  Basic situation of basic old-age insurance system

(two) the operation of the basic old-age insurance fund

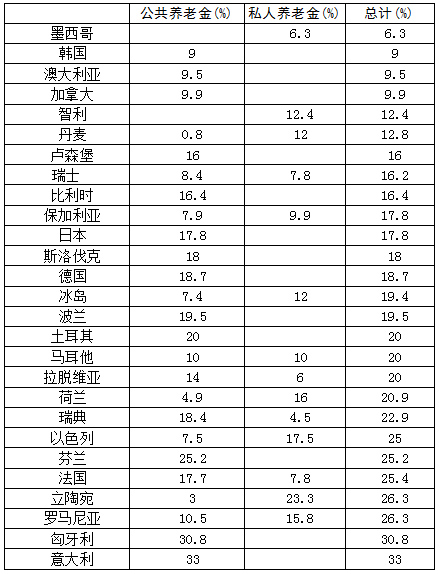

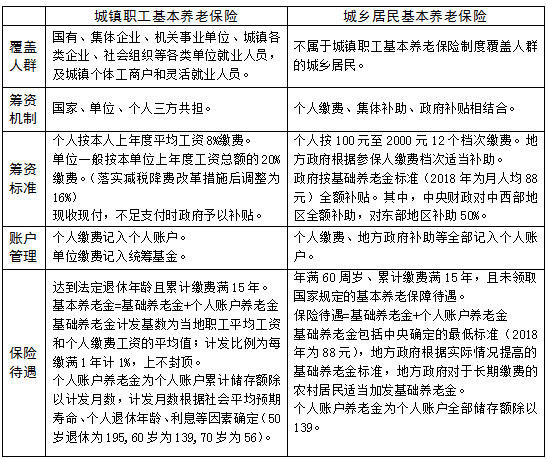

In 2018, the total income of the national basic endowment insurance fund was 5,483.6 billion yuan, of which the insurance premium income was 3,969.5 billion yuan, accounting for 72.4%; The fiscal subsidy income was 1,215.3 billion yuan, accounting for 22.2%. The total expenditure of the fund was 4,718.7 billion yuan, of which the basic pension expenditure was 4,571.3 billion yuan, accounting for 96.9%. The balance of the fund’s income and expenditure in that year was 764.9 billion yuan, and the accumulated balance of the fund was 5,784.7 billion yuan (see Table 2 for details).

Table 2  Operation of Three Types of Basic Endowment Insurance Funds in 2018

(3) Central financial subsidies

The central government has given subsidies to the basic old-age insurance for enterprise employees, the basic old-age insurance for urban and rural residents and the basic old-age insurance for government agencies and institutions. In 2018, the total subsidy from the central government was 662.8 billion yuan.

Subsidies for basic old-age insurance for enterprise employees.Since 1999, the central government has given subsidies to enterprises with difficulties in some areas in terms of the fund gap of basic old-age insurance, the implementation of personal accounts and the improvement of pension benefits. Among them, 40% of the funds needed to improve the pension payment standard are subsidized to the central and western regions and old industrial bases, and 100% is subsidized to Xinjiang Corps; For the existing pension expenditure, according to the financial resources, fund gap, support rate and work effect of each region, the subsidy funds are allocated by factor method. In 2018, the central government issued a subsidy of 483.1 billion yuan for basic old-age insurance for enterprise employees.

Subsidies for basic old-age insurance for urban and rural residents.The central government gives full subsidies to the central and western regions according to the basic pension standards set by the central government, and 50% subsidies to the eastern regions. In 2018, the central government issued a subsidy of 141.6 billion yuan for basic old-age insurance for urban and rural residents.

Subsidies for the reform of endowment insurance in institutions and institutions.The central government subsidizes 40% of the funds needed to adjust the pension payment standard in the central and western regions and old industrial bases except Beijing and other seven provinces and cities. In 2018, the central government issued a subsidy of 38.1 billion yuan for the reform of endowment insurance for institutions and institutions.

(four) the basic old-age insurance fund budget management

The budget of social insurance fund is one of the "four accounts" of the government stipulated in the Budget Law. In 2010, the State Council decided to establish a standardized and unified social insurance fund budget system nationwide, and began to compile it on a trial basis that year. In 2014, it was officially included in the draft government budget submitted to the National People’s Congress for examination and approval.

The basic old-age insurance fund budget mainly follows the principles of "establishing according to law, standardizing and unifying, making overall plans, defining responsibilities, earmarking special funds, being relatively independent and organically connected, making ends meet, and leaving a balance". The compilation process adheres to the bottom-up and joint review, which is compiled by the social insurance agencies in the areas where the basic old-age insurance fund is co-ordinated. After being summarized by the human resources and social security departments and audited by the financial department, it is jointly reported to the people’s government at the same level and reported to the people’s congress at the same level for examination and approval. The national basic old-age insurance fund budget is compiled by Ministry of Human Resources and Social Security, reviewed and summarized by the Ministry of Finance, and submitted to the State Council for examination and approval by the National People’s Congress. Among them, the budget revenue preparation comprehensively considers the implementation of the fund budget in the previous year, the forecast of the economic and social development level in this year, the social insurance work plan and other factors, including the number of participants, the number of payers, the base of payment wages, etc. Expenditure budgeting comprehensively considers the changes in the number of people enjoying pension insurance benefits in the overall planning area this year, the economic and social development, the adjustment of pension insurance policies and the changes in pension insurance treatment standards.

In recent years, governments at all levels and their relevant departments have continuously improved the budget management system, studied and established an incentive and restraint mechanism, standardized the preparation process and improved the preparation method by means of informationization and big data, effectively enhanced the planning and binding nature of the budget, paid close attention to the budget implementation management, standardized the collection of premiums and the payment of insurance benefits, strived to achieve all the insurance coverage, and resolutely paid it in full and on time, and achieved positive results. In some places, by hiring third-party evaluation agencies to improve the index system of fund budgeting, establish and improve the actuarial index system of fund budgeting, and improve the scientific and accurate budgeting.

(V) Progress of relevant reforms

1. Promote the provincial-level co-ordination of endowment insurance for enterprise employees.Up to now, 13 provinces in China have realized the provincial-level unified collection and expenditure of enterprise employee pension insurance funds. Other provinces have formulated implementation plans according to the actual situation and are steadily advancing the implementation in accordance with the task requirements of the State Council to fully realize the provincial-level unified collection and support of funds by the end of 2020. In some places, the establishment of a unified revenue and expenditure system including pension insurance policy, fund budget, fund revenue and expenditure management, responsibility sharing mechanism, information system, handling management and performance appraisal mechanism has been promoted, which has laid an institutional foundation for ensuring the reform of unified revenue and expenditure.

2. Implement the central adjustment system of the basic old-age insurance fund for enterprise employees.The central adjustment system mainly includes: first, the adjustment fund raising system. According to 90% of the average wage of employees in each province and the number of employees who should be insured on the job as the base for calculating the amount of the solution, solution ratio started from 3%, and the funds of the provinces were summarized to form the central adjustment fund. The second is the allocation system of swap funds. The central adjustment fund was fully allocated to local governments in that year, and the amount of funds allocated to the provinces was calculated according to the approved number of retirees in each province and the national per capita allocation. At the same time, the central and western provinces with heavy tasks of poverty alleviation will be exempted from their net contribution responsibility by 2020.

The central adjustment system was implemented on July 1, 2018. In that year, the total size of the central adjustment fund was 242.23 billion yuan, and the actual difference was 61.03 billion yuan. There are 7 provinces, including Guangdong, Beijing, Zhejiang, Jiangsu, Shanghai, Fujian and Shandong. 22 central and western regions and old industrial base provinces benefited, including Liaoning, Heilongjiang, Sichuan, Jilin and Hubei. Exempt Guizhou, Yunnan and Tibet from net contribution responsibility. Since the implementation of the central adjustment system, it has played a positive role in alleviating the payment pressure of some local funds and ensuring the timely and full payment of pensions. In 2019, the proportion of central adjustment will increase to 3.5%. It is estimated that the total size of central adjustment funds in the whole year will be 630.3 billion yuan, and the difference will be 151.2 billion yuan.

3. Reduce the burden of social security contributions.From 2015 to 2018, the State Council has reduced the social security rate five times, involving basic old-age insurance, unemployment insurance, industrial injury insurance and maternity insurance for enterprise employees. The overall level of the five social security rates for employees in China has been reduced from 41% to 36.95%, of which the unit contribution rate has been reduced from 30% to 26.45%. By April 30 this year, when the phased rate reduction policy expires, the burden on enterprises will be reduced by nearly 500 billion yuan.

This year, the State Council decided that from May 1st, the unit contribution rate of basic old-age insurance for enterprise employees can be reduced from 20% to 16%, and the policy of reducing unemployment and work-related injury insurance rates by stages will be extended to the end of April 2020. At the same time, it is approved to lower the base of social security contributions, from the past based on the average salary of employees in non-private units in cities and towns to the average salary of full-caliber employees weighted by non-private units and private units in cities and towns. According to the calculation of the relevant departments in the State Council, after the implementation of the new fee reduction measures, it is estimated that the social security payment burden of enterprises will be reduced by more than 400 billion yuan in 2019.

4. Transfer some state-owned capital to enrich the social security fund.Transferring some state-owned capital to enrich the social security fund is an important measure to enhance the sustainability of the basic old-age insurance system. By the end of 2018, the pilot reform of five central enterprises and central financial institutions, including Zhejiang and Yunnan provinces and China Unicom and China Reinsurance, had been basically completed. In December 2018, the second batch of transfer work at the central level was started. The transfer enterprises included 15 central management enterprises such as China Huaneng and 4 central financial institutions such as PICC China. In July 2019, the State Council decided to fully push forward the central and local governments to transfer some state-owned capital to enrich the social security fund. At the central level, qualified enterprises will be basically completed by the end of 2019, enterprises with real difficulties can be completed by the end of 2020, and enterprises run by central administrative institutions will be transferred after the centralized and unified regulatory reform is completed; At the local level, the transfer will be basically completed by the end of 2020. Up to now, the central level has completed the transfer of 67 central enterprises and central financial institutions in three batches, with a total transfer of state-owned capital of about 860.1 billion yuan. The mechanism of state-owned capital to make up for social security fund has been initially established, which has promoted the diversified reform of state-owned equity.

5. Reform of social security collection system.The Plan for Deepening the Reform of Party and State Institutions in 2018 clearly stipulates that since January 1, 2019, all social insurance premiums will be uniformly collected by the tax authorities. The State Council attaches great importance to improving the reform of the social security fee collection system. According to some new situations and problems in the process of reform, it has made new adjustments and arrangements for the transfer of social security fee collection and management responsibilities of enterprises in a timely manner, requiring that in principle, the current collection system should be continued temporarily, and "a mature province should be handed over to a province". Up to now, among the 37 regions (provinces, autonomous regions, municipalities directly under the Central Government, Xinjiang Production and Construction Corps and cities with separate plans), 21 regions were originally collected by the tax authorities, and the tax authorities collected all social security fees; In 16 areas where the social security department originally collected the social security fees of enterprises, the social security fee collection and management responsibilities of enterprises have not been transferred yet, and they will continue to be collected by the social security department, and the social security fee collection and management responsibilities of institutions and urban and rural residents will be transferred to the tax department; The tax authorities in 22 regions are also responsible for collecting occupational annuities.

Second, the main problems and shortcomings

Over the years, China has made great achievements in promoting the construction of a comprehensive, basic and sustainable multi-level social security system, and basically established a social security network covering all people. Judging from the overall situation of the basic old-age insurance in China, the system has been continuously improved, the level of protection has been continuously improved, the fund operation has been generally stable, and the current income and expenditure are still in balance. However, the survey also found that the gap between the fund’s current income and expenditure showed an expanding trend, and the accumulated balance of individual provinces "bottomed out", which further increased the potential risk of the fund; Fund budget management is generally extensive, and some institutional issues are not paid enough attention, and the scientific, refined and modern level of budget management is low; The design of endowment insurance system is not perfect enough to meet the needs of reform and development, which seriously affects the sustainability and credibility of the system. These problems must be solved quickly.

(A) The contradiction between revenue and expenditure has become increasingly prominent, and related risks have begun to emerge.

First, the growth of insurance premium income is relatively weak.Comparing the premium income of the basic old-age insurance for enterprise employees in China with the basic pension expenditure, the income and expenditure gap of 31.9 billion yuan first appeared in 2014, and it has expanded to 77.3 billion yuan in 2018. Many places reflect that due to the accelerated process of population aging, the dependency ratiooneThe sustained and rapid decline has caused the growth of fund income to be lower than the growth of expenditure for a long time, resulting in the widening gap between fund income and expenditure. In recent years, the implementation of tax reduction and fee reduction policy has also reduced the current collection income to some extent. The survey found that Northeast China is still facing the reality of a large outflow of population, especially young and middle-aged people, and it is difficult to reverse the situation of decreasing dependency ratio, and it is increasingly difficult to promote the growth of premium income.

Second, there is a great pressure on financial subsidies.Since 2005, the basic pension treatment standard for enterprise employees has been raised for 15 consecutive years, and the financial departments at all levels have borne the corresponding increased expenditures. The basic old-age insurance for urban and rural residents is to provide old-age insurance for urban and rural residents without income sources. The financial system bears the main responsibility, and some local financial subsidies account for more than 70%. The reform of endowment insurance in institutions has also put forward a lot of expenditure requirements for governments at all levels, and there is still a certain income and expenditure gap in some places under investigation.

Third, problems left over from history bear a heavy burden in some areas.There has been no clear and detailed solution to the transition cost of the old-age insurance system. For the "old people" who have no personal account accumulation and the "middle people" who have insufficient personal account accumulation, the pension benefits enjoyed according to the regulations of deemed payment are paid by the funds collected in the current period. After the implementation of the reform of state-owned enterprises and the diversion of laid-off workers, state-owned enterprises went into battle lightly and developed well. However, the remaining problems of "early retirement" employee pension insurance have not been properly solved, which has brought a huge burden to some places. The reform of transferring some state-owned capital to enrich the social security fund is progressing slowly, some departments and enterprises are resistant, and there are not many local state-owned enterprises worth transferring, so the overall reform effect is not great. In some places, it is reflected that the large-scale collective reform of factories and enterprises, de-capacity, etc. have increased the pressure on the fund’s income and expenditure from two aspects: reducing the arrears of enterprises, ensuring development and increasing expenditures, and need the support of the central government.

Fourth, the sustainability of the fund is under great pressure.The relevant departments in the State Council organized and carried out the long-term actuarial analysis of the basic old-age insurance. Although the results of various departments and institutions are different, the general judgment is that for a long time to come, the degree of population aging in China will become increasingly serious, the dependency ratio within the system will continue to decline, and the sustainability of the old-age insurance fund will face severe challenges.

(B) The budget management is relatively extensive, and the system and mechanism need to be improved urgently.

First, the provisions on budgeting responsibilities are not clear enough.The Opinions of the State Council on Implementing the Budget of Social Insurance Fund issued in 2010 stipulates that the main body of compiling the budget of social insurance fund is the human and social departments, and the financial department only undertakes the audit responsibility. The Budget Law revised in 2014 stipulates that the financial departments of governments at all levels are responsible for the specific preparation of budgets. According to the investigation, the provisions of the State Council’s opinion are still implemented, and there are different understandings about the provisions of the budget law, especially about "preparation" and "the subject of social insurance fund budget preparation". In some places, it is pointed out that the division of responsibilities for fund budgeting is not clear enough, the participation of financial departments is insufficient, and the implementation of responsibilities is not enough.

Second, the budget preparation procedure is not reasonable enough.Restricted by the level of fund overall planning, the current budget adopts the procedure of overall planning, bottom-up and layer-by-layer summary. There are too many compiling subjects, different policy understandings and different interests, which makes it difficult to effectively play the role of overall budget arrangement, resulting in the conservative compilation of income budgets in some areas, and the phenomenon that expenditures exceed the budget sometimes occurs. Especially after putting forward the reform direction of national overall planning, some places have the mentality of "receiving less and spending more". The audit department reported that in some co-ordination areas, artificially depressing the budget revenue and inflating the expenditure budget has become the norm, resulting in a serious deviation from the reality of the fund budget and poor effectiveness of budget management.

Third, the foundation of budget management is relatively weak.Due to the low level of overall planning of the basic old-age insurance fund, the basic data such as the number of insured persons, the actual payment base and rate, and the basis of pension calculation and distribution required for budget management are scattered in various overall planning areas. Some central departments and provincial management departments have indicated that they do not fully grasp accurate information, and some local data indicators are not scientifically collected, so the credibility and transparency are not high. Strengthening budget management has become a passive water without a root. On the other hand, social security agencies are in the front line of fund budgeting, but they lack effective access to relevant economic and social data, especially the information available to grass-roots social security agencies is more limited, and the basic quality of budgeting is not high.

Fourth, the refined level of budget management is not enough.Judging from the draft fund budget submitted to the National People’s Congress, it is mainly a few large numbers such as income, expenditure and balance, lacking detailed data by region, industry and population, and the readability and auditability of the budget are not strong. From the perspective of budget preparation, although there are requirements for the reference factors of fund revenue and expenditure preparation, a unified and standardized index system has not yet been established, and different places have different understanding of policies by industry and population, and their calculation methods are also different. From the perspective of budget implementation, many places and even some places where there is a big contradiction between fund revenue and expenditure only emphasize the hard constraint of budget, and have not taken the initiative to establish a regular analysis system for fund budget implementation. The response to changes in industries and people reflected by the implementation situation is relatively lagging behind, and the fund risk early warning mechanism and response plan have not been effectively established.

Fifth, actuarial analysis is seriously lagging behind.There is a big gap between the actuarial work of the basic old-age insurance fund and the actual demand in the aspects of system construction, talent team construction and the application of actuarial results, and a standardized actuarial analysis mechanism combining long, medium and short term has not been established. As an important part of budget management, fund actuarial has not been brought into the budget management category, resulting in poor predictability and scientificity of budget revenue and expenditure preparation, lack of preparation for possible fund risks and even financial risks, and weak ability to effectively deal with population aging.

Sixth, the informatization construction is weak.The preparation, implementation, audit and supervision of the fund budget involve many departments and institutions such as human society, finance, taxation, auditing and social security agencies. At present, a unified, standardized and dynamically shared information database has not been established, and each department and institution relies on the information system of this system for management. Repeated construction and decentralized maintenance consume a lot of manpower and material resources, and information data cannot be effectively shared, which also affects the accuracy of relevant data and information.

(C) The design of the old-age insurance system is not perfect, and the pace of reform needs to be accelerated.

First, the low level of fund overall planning has become the primary problem to be solved urgently.Judging from the basic endowment insurance fund for enterprise employees, most provincial-level places have not yet achieved real provincial-level overall planning, and many places are still municipal-level and county-level overall planning. The low level of overall planning makes it difficult to fully realize the transfer of funds between different overall planning areas, and the law of large numbers of insurance cannot be fully exerted. At the same time, the fund balance is mainly deposited in the labor inflow areas, but the labor outflow areas have to bear the pressure of issuing a large number of old-age benefits for the returning laborers. This extremely uneven distribution of funds not only makes the labor outflow areas such as the central and western regions dissatisfied, but also makes the interest pattern of low-level overall planning gradually solidify. Some places with fund balances regard the balance as local "own" resources and advantages, and there is resistance to national overall planning and entrusting the National Social Security Fund Council to invest and operate. Lack of awareness that basic old-age insurance is a "national system" makes the reform more and more difficult. Some provinces surveyed reflect that they are not optimistic about realizing the provincial-level unified collection and expenditure of funds in 2020.

Second, the irregular implementation of policies such as payment base, rate and pension benefits has brought many disadvantages.Due to the low level of fund co-ordination, the relevant departments give local governments some autonomy in terms of payment base, rates and pension benefits. In actual implementation, the co-ordination places with large contradiction between fund revenue and expenditure tend to be strict base and high rate, while the co-ordination places with more fund balances tend to be wide base and low rate, which is quite different among regions. In terms of rates, Zhejiang, Guangdong and Xiamen, which have more fund balances, stipulate unit payment rates of 14%, 13% and 12% respectively. In terms of payment base, some places allow enterprises to determine the base according to a certain proportion of total wages. In terms of pension benefits, different places have different definitions of the standard of deemed payment, and some people think it is unfair. The disunity of local policies not only causes the inconsistent foundation and unclear base of fund budget preparation, but also brings difficulties to improve the overall planning level; It also causes unfairness at the institutional level, affects the free flow of resources and intensifies regional differences. It is found that many places have introduced preferential policies to reduce and exempt insurance contributions, which, as an important means of attracting investment, have a great impact on normal investment attraction in other places, especially in areas with large contradictions between fund income and expenditure. Some parts of Northeast China reflect that it has faced a vicious circle of "the contradiction between fund income and expenditure is prominent → the approved payment base and rate are strict → it is in a disadvantageous position of attracting investment → enterprises move out because of the high payment of endowment insurance → the economic development is slow and the employment population is small → the contradiction between fund income and expenditure is more prominent".

Third, the incentive and restraint mechanism is not perfect enough.From the basic old-age insurance for enterprise employees, it is generally reflected in all aspects that the nominal rate of 28% (unit 20%+ individual 8%) is obviously high, and it is still higher than the level of some major western developed countries after reducing the rate this year. In order to reduce costs and maintain operations, many enterprises, especially private enterprises, tend to lower or even falsely report the payment base, and some tax collection management departments also "know without asking", so the seriousness and binding force of the system are poor. Some experts pointed out that the fund implements the mechanism of combining social pooling with individual accounts, but all individual contributions are credited to individual accounts, resulting in no contribution to overall adjustment of individual contributions, and individuals lack a sense of responsibility for the basic endowment insurance system. The minimum payment period of 15 years for receiving pension is not only short, but also the system design is not regarded as the minimum period for fulfilling legal obligations. In addition, the cumulative algorithm is adopted for 15 years calculation, and it is not uncommon to interrupt payment. From the perspective of the basic old-age insurance for urban and rural residents, because the overall planning part is almost entirely borne by the finance, the system is welfare-oriented, plus the basic pension level and the average replacement rate2Low (in some places, the average replacement rate is only about 9%), residents’ enthusiasm for participating in insurance is not high, and the participation rate has declined in some places. Even if they are insured, most people tend to choose the lowest payment grade. In the old-age insurance, the basic pension calculation and payment methods linked to benefits, such as overpayment, long-term payment and late retirement, need to be improved.

Fourth, the construction of a multi-level endowment insurance system lags behind.The target design of the multi-level endowment insurance system in China includes three pillars, the first pillar is basic endowment insurance, the second pillar is enterprise annuity and occupational annuity, and the third pillar is personal savings endowment insurance and commercial endowment insurance. At present, there is no clear plan for the overall protection degree of multi-level pension insurance system and the target level of overall pension replacement rate. Among them, there is also a lack of clear quantitative requirements for the status and role of each pillar. In practice, the basic old-age insurance is a monopoly, the whole society’s old-age responsibility, and the high, middle and low levels of old-age demand are all on the basic old-age insurance; The coverage rate of the second pillar is low, and its development is obviously lagging behind. By the end of 2018, there were 110 million market entities in China, and less than 0.1% of enterprises established enterprise annuities, most of which were large and medium-sized state-owned enterprises, and less than 10% of employees participated in the basic old-age insurance. The third pillar has just begun to be piloted, and there is still a lack of effective encouragement and support policies. Highly dependent on the basic old-age insurance as the first pillar, resulting in a high payment rate, most enterprises are unable to build supplementary old-age insurance for employees, limiting the development of the second and third pillars, forming a situation of "single tree is difficult to support".

Fifth, the relevant reforms are not in place and affect the improvement of the system.Many localities and experts have reported that the implementation of the reform of the collection system of social insurance funds and the unified collection of social insurance premiums by tax authorities will be conducive to realizing the payment base of enterprises and finding out the base, laying a foundation for further improving the fee-based system. Implementing large-scale tax reduction and fee reduction, reducing the social security payment rate of enterprises and reducing the burden on enterprises are also necessary measures to cope with the downward pressure on the economy. If we strengthen overall coordination and require enterprises to make a real payment base while reducing the rate, the overall effect of the policy "combination boxing" should be more obvious. However, due to the lack of coordination in actual implementation and the strong social reaction, the reform of the collection system has basically stagnated, and the goal of standardizing the fee base and realizing the fee base cannot be achieved.

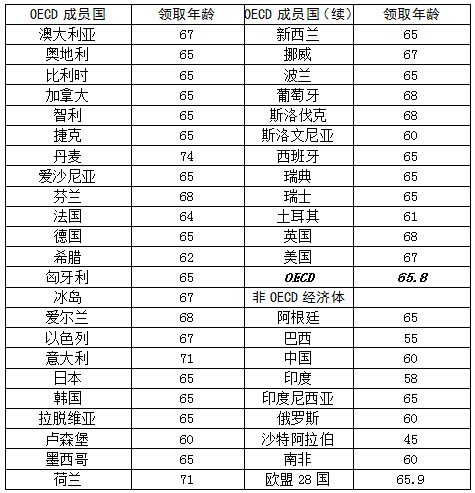

The reform of delayed retirement age has been put forward for many years, but the implementation plan has been delayed, and there are many social discussions. Not only has the window period of reform been continuously shortened, but it has also affected the due effect of reform; It also leads to unclear social expectations and lack of effective guidance of public opinion. It has been pointed out that the provision of early retirement for special jobs has not been adjusted for a long time, which is not in line with the actual situation, which is not conducive to stabilizing the income of the fund, and even some enterprises have compiled false materials for reducing staff and increasing efficiency and for early retirement of employees. From the international experience, delaying retirement age or receiving pension age has become a unanimous choice for major developed economies represented by OECD countries to effectively deal with population aging, and many countries have also adopted different degrees of restrictions on early retirement.

The reform of entrusted investment is progressing slowly, and the balance of funds used for investment and operation is less. According to the statistics of the National Social Security Fund Council, the total amount of contracts entrusted to it for investment at the end of 2018 was about 858 billion yuan, accounting for 14.8% of the total balance of the national endowment insurance fund at the end of 2018. Most of the fund balances were still in bank deposits, and the overall ability of the fund to maintain and increase value was not strong.

Third, relevant suggestions

The problem of providing for the aged is related to people’s happiness and well-being, social harmony and stability, and long-term stability of the country. In the face of new situations and challenges such as the new normal of economic development and the accelerated aging of the population, we must adhere to the guidance of Socialism with Chinese characteristics Thought of the Supreme Leader in the new era, conscientiously implement the major decision-making arrangements of the party and the state on the reform of the old-age insurance system, maintain and enhance the credibility of the social security system, enhance the people’s sense of identity and confidence, and enhance their overall awareness, crisis awareness and responsibility awareness. With greater determination and courage, we will promote the reform of the old-age insurance system, improve the scientific and fair nature of the system, strengthen the income capacity of the old-age insurance fund, strengthen and standardize the budget management of the old-age insurance fund, effectively prevent and resolve risks, and enhance the sustainability of the fund by developing the economy, expanding the coverage, increasing the rate of maintaining and increasing the value of surplus funds, and standardizing financial subsidies.

(1) Effectively enhance the sense of urgency and responsibility, and accelerate the implementation of various reforms.

We should fully understand the significance of the normal operation of the basic old-age insurance fund for safeguarding people’s interests and social stability, fully understand the grim situation faced by the old-age insurance system and the fund operation, fully understand the time pressure of gradually narrowing the reform window, further enhance the sense of crisis, enhance the sense of urgency in promoting the reform of the old-age insurance system, make up our minds to speed up the reform, seize the day and wait for no time, intensify the implementation of the CPC Central Committee’s decision-making and deployment on the reform of the old-age insurance system, and improve the system and mechanism so as to make relevant reform plans as soon as possible. It is necessary to accurately grasp the downward trend of the dependency ratio brought about by the acceleration of the aging population, effectively resolve the risks caused by the increasing income of the basic old-age insurance fund year by year, actively respond to the problem of the sustainability of the fund that the whole society is highly concerned about, and some people are worried that they may not get a pension in the future when they participate in the basic old-age insurance system, and pay attention to and reverse the tendency of some enterprise employees and residents to stop paying their fees after participating in the insurance, and some young people who have just joined the work are unwilling to pay for the insurance. It is necessary to improve the operating efficiency of the fund by improving the system. We should attach great importance to strengthening the management of income and expenditure of the basic old-age insurance fund, regard ensuring the sustainability of the fund as the top priority and the most important responsibility of governments at all levels, and take the fund budget management and actuarial analysis as the important starting points to effectively improve the scientific, refined and modern level of fund management.

(B) to speed up the improvement of the old-age insurance system, improve the scientific and fair system.

The first is to improve the top-level design of the target framework of the multi-level endowment insurance system.Further clarify the overall replacement rate target of the old-age insurance system and the proportion that each pillar should share, and accelerate the construction of a multi-level old-age insurance system. It is suggested to refer to the International Labour Organization’s Convention on the Minimum Standards of Social Security and international experience, and combine the actual situation of China’s economic and social development and residents’ old-age habits to define the overall replacement rate target, ensure that the basic living standards of workers before and after retirement are roughly the same, and improve the mechanism for dynamically adjusting the replacement rate target according to the level of economic and social development and financial affordability. Optimize development goals and policies, make clear that the basic old-age insurance is fully covered and basic, speed up the improvement of relevant fiscal and tax policies, actively guide and promote the healthy development of the second pillar (enterprise annuity and occupational annuity) and the third pillar (personal savings endowment insurance and commercial endowment insurance), and form a three-pillar structure of old-age insurance. Further consolidate the security responsibilities that units and individuals should bear in the field of old-age care, and form a good situation in which the state, units and residents participate and share reasonably and actively respond to the aging population.

The second is to introduce reform measures such as delaying the age of receiving pensions and raising the minimum payment period as soon as possible.In order to study and reform the conditions for receiving pensions, it is suggested that the pension age should no longer be linked to the retirement age, and a gradual reform plan for delaying the age of receiving pensions should be formulated and implemented as soon as possible, and the "small steps and quick steps" should be delayed in stages to effectively guide the expectations of the masses. Adjust the conditions for receiving full pension benefits accordingly, and reduce those who are not old enough and have insufficient payment years in proportion. It is suggested to study and increase the minimum payment period of receiving pension, and set restrictions on the number and interval of interruption of payment.

The third is to accelerate the national overall planning of basic old-age insurance.The relevant departments of the central government should strengthen the planning and design of the national overall planning system, and properly handle the relationship between promoting the reform of overall planning level, mobilizing local enthusiasm, and consolidating local main responsibility. They can learn from the experience and practices of establishing a gap responsibility sharing mechanism in some places to prevent "eating from the same pot" and "whipping the cattle". It is necessary to seriously study and establish an effective linkage mechanism between the realistic differences in pension treatment levels between regions and the implementation of national pension planning, and formulate a transition plan to protect the reasonable rights and interests of the people. It is necessary to strengthen the guidance for local governments to carry out the reform of provincial-level unified revenue and expenditure, ensure that the reform tasks are put in place before the end of 2020, and avoid doing things in their own way, so as to create favorable conditions for promoting national overall planning. On this basis, study and formulate a timetable and road map to achieve national overall planning.

The fourth is to improve the incentive and restraint mechanism.It is necessary to improve the incentive mechanism of overpayment, overpayment for a long time and overpayment for late retirement, improve the relevant systems such as the mechanism of linking treatment with payment, optimize the identification criteria for special types of work, and improve the early retirement policy. For those who choose to retire early or late, the level of pension benefits can be reduced or improved according to the corresponding number of years; For flexible employees, urban and rural residents insured, etc., study and improve the financial subsidy policy for payment, and guide the reasonable increase of payment level. In accordance with the principle of "low fee rate and wide fee base", we will establish a linkage mechanism to reduce the payment rate and make a real payment base, and steadily promote the reform of the collection system of old-age insurance premiums without basically increasing the burden of payment. It is necessary to further implement the relevant legal requirements, strictly review the fund’s participation in insurance and collect fees, strengthen the awareness of participating in insurance and paying fees according to law by strengthening publicity and guidance, and improve the inspection and punishment mechanism to prevent illegal phenomena such as missing payment, underpayment and non-payment, and improve the participation rate and payment rate.

(3) Standardizing fund revenue and expenditure and improving the ability to cope with payment risks.

First, based on economic development, enhance the fund’s income potential.Development is the key to solve many economic and social problems in China. To solve the contradiction between income and expenditure of the basic old-age insurance fund, we must rely on developing the economy, expanding employment, raising the income level and broadening the fee base of the old-age insurance fund. We must adhere to the new development concept, promote high-quality development, persist in promoting reform and opening up, conscientiously implement the decision-making arrangements of the CPC Central Committee, and make overall plans to stabilize growth, promote reform, adjust the structure, benefit people’s livelihood, prevent risks, and ensure stability, promote sustained and healthy economic development, continuously improve people’s income levels, and consolidate the income base of the fund.

The second is to do a good job in expanding the collection and raising the participation rate and payment rate.It is necessary to use modern information technologies such as big data and cloud computing to strengthen the inter-departmental information sharing and coordination linkage mechanism, promote the free connection and transfer of endowment insurance in an orderly manner throughout the country, improve management ability and service level, focus on the participation of employees in non-public economic organizations and flexible employees in cities and towns in endowment insurance, accelerate the adaptation to the new economy and new formats such as webcasting, promote the classification, accurately expand the coverage, and improve the participation rate, so as to ensure that all insurance is guaranteed. It is necessary to actively and steadily carry out historical arrears and payment audits in accordance with the law, improve the financial subsidy policy for insurance payment, and promote the increase of payment rate.

The third is to increase entrusted investment and improve the level of maintaining and increasing the value of surplus funds.It is necessary to further actively and steadily promote the entrusted investment of the surplus funds of the basic old-age insurance fund, strive to increase the proportion of entrusted investment funds under the premise of ensuring the safe payment of pensions, and strive to enhance the ability of the fund to maintain and increase its value. We should adhere to the principle of prudent investment, promote diversification of asset allocation, make good use of financial instruments such as insurance and reinsurance, and strive to achieve a long-term stable and relatively high income level.

The fourth is to standardize the financial subsidy system and give play to the role of financial support.Further clarify the functional orientation of financial subsidies, improve the ways of financial subsidies, establish a scientific mechanism for determining financial subsidies, and effectively play the institutional functions of financial subsidies. We will study and improve the fiscal and taxation policies to support the development of the old-age insurance system, implement tax-free policies for the payment, operation and income of enterprise (occupational) annuities, accelerate the promotion of personal tax deferred old-age insurance, and enhance the attractiveness, stability and sustainability of the old-age insurance system.

The fifth is to reform and standardize the treatment adjustment mechanism and fund expenditure arrangements to improve the matching degree with income.Standardize the adjustment of insurance benefits, combine the target level of replacement rate, and establish a scientific, reasonable and predictable normal insurance benefits adjustment mechanism that is coordinated with economic development indicators and residents’ income growth indicators. In view of the payment difficulties caused by the heavy historical burden in specific areas, we should study and improve the commitment mechanism to realize the shift from "passively filling the gap" to "actively solving the problem". We will further reform the transfer of state-owned capital, improve the operating budget system of state-owned capital, and solve historical problems such as the reform of state-owned enterprises and the reform of large-scale collective factories. Seriously sorting out and studying the stock debt problems caused by the guarantee of pension payment in some places, we should not only face up to the difficulties caused by the defects of the system itself, but also take effective measures to support local governments to solve debt risks in a safe and orderly manner, and also clarify unreasonable violations of laws and regulations in implementation, increase accountability and urge the implementation of rectification.

(four) improve the fund budget system to ensure the sustainability of the fund.

First, improve the legal system related to the pension fund budget.Do a good job in the organic connection between the Budget Law, the State Council’s Opinions on Implementing the Budget of Social Insurance Fund and other relevant laws and regulations, speed up the revision and promulgation of the Regulations on the Implementation of the Budget Law, clarify the rights and obligations of all relevant subjects in the fund budget, and suggest further consolidating the main responsibilities of financial departments at all levels in the preparation, implementation and management of the basic old-age insurance fund budget. Study and formulate a unified national social security fund budget management method, standardize the fund budget preparation, implementation and management, and establish a budget adjustment mechanism that conforms to the characteristics of the social security fund budget.

The second is to establish and improve a budget system that is compatible with national overall planning.It is necessary to speed up the establishment of a unified system for compiling the budget of the basic old-age insurance fund by the central government, give play to the role of overall planning and coordination by the central government, and lay the foundation for realizing the national unified collection and expenditure of the basic old-age insurance fund. Improve the construction of budgeting index system, increase the expected growth rate of full-caliber social average wage, expected rate of return on entrusted investment, life expectancy per capita, population growth rate, aging speed and other expected indicators, carry out scientific and standardized fund revenue and expenditure forecast, and improve the scientificity and accuracy of budgeting. Improve the regular analysis system of fund budget implementation, establish risk early warning mechanism and emergency response mechanism, and enhance the timeliness and effectiveness of fund audit. Establish an administrative supervision system and an audit supervision system for social security funds, strengthen social supervision, intensify the crackdown on corruption, misappropriation and malicious insurance fraud, and ensure the safety of funds.

The third is to establish an analysis system of actuarial balance of funds.It is necessary to strengthen the top-level design, establish a scientific and standardized actuarial balance calculation and analysis system for basic old-age insurance funds, and carry out actuarial analysis regularly. According to the long-term demographic changes and economic and social development trends, based on the important factors such as target replacement rate, payment base, rate, and return on investment, improve the actuarial analysis model. Improve the application mechanism of actuarial analysis results in fund budget preparation and endowment insurance policy formulation, and realize sustainable intergenerational balance by dynamically adjusting the level of payment and payment, improving the government subsidy mechanism, and promoting the reform of endowment insurance system.

The fourth is to strengthen the basic work of budget management and information construction.Improve the basic system of data collection and processing, and establish relevant standardization norms to ensure that the basic data is true, accurate, verifiable and comparable. Integrate the existing information systems of various departments and promote the construction of a unified, standardized and dynamically shared national information database. Strengthen the use of data analysis, with the help of modern information technologies such as big data and cloud computing, support the calculation and analysis of fund actuarial balance, strengthen real-time monitoring and analysis of fund operation, and improve the accuracy and modernization level of fund budget management.

The fifth is to strengthen the review and supervision of the budget of the endowment insurance fund by the National People’s Congress.Standardize and improve the preparation of the basic old-age insurance fund budget, further improve and refine the draft budget of the basic old-age insurance fund, increase the sub-regional budget table, and provide the basis, parameter description and performance objectives of the basic old-age insurance fund budget as annexes to the draft budget to improve the readability and auditability of the budget. Give full play to the audit role, deepen the substantive review of the pension fund budget with the help of modern information means such as budget networking supervision system, improve the ability of the National People’s Congress and provincial people’s congresses to review and supervise the pension fund budget, ensure the sustainability and fairness of the pension fund, and enhance the credibility, attraction and cohesion of the pension insurance system.

1  Dependence ratio = working-age population: non-working-age population.

2  Pension replacement rate refers to the ratio between the level of pension collection and the level of wage income before retirement, which is used to measure the difference of living security level between workers before and after retirement.

The National People’s Congress Standing Committee (NPCSC) social basic endowment insuranceSpecial research group on fund budget management and reform

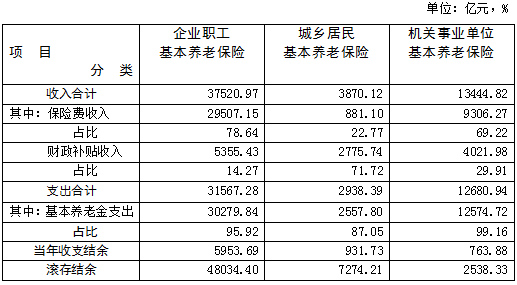

Schedule 1

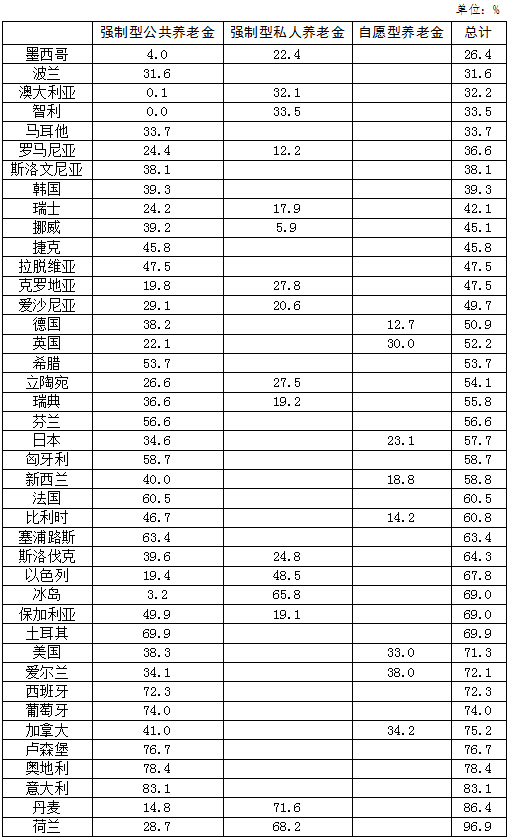

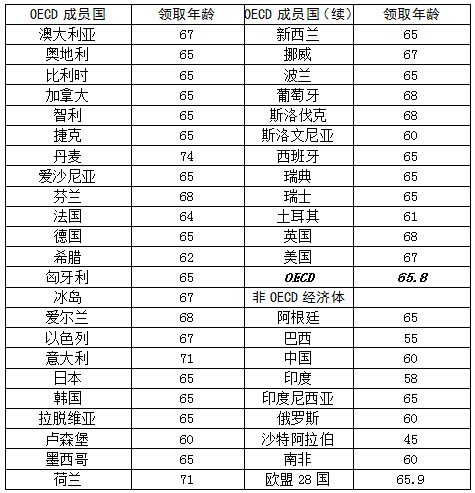

Average contribution rate of compulsory pensions for employees in some OECD countries in 2016

fillPublic pension: a compulsory pension plan initiated and managed by the public sector of the government, and the government bears direct financial responsibility for the public pension plan. Generally speaking, public pension is equivalent to the "first pillar" of old-age insurance.

Private pension: The organizers include private entities such as individual enterprises, enterprise alliances, trade unions and financial intermediaries approved by the government. All kinds of occupational pensions, enterprise annuities and personal pensions belong to the category of private pensions. The government usually does not bear the direct or final financial responsibility for private pensions, but it has the responsibility of supervision. Private pensions are divided into compulsory and voluntary types. Generally speaking, compulsory private pension is equivalent to the "second pillar" of old-age insurance, and voluntary pension is equivalent to the "third pillar".

Source: OECDPensionsOutlook2018

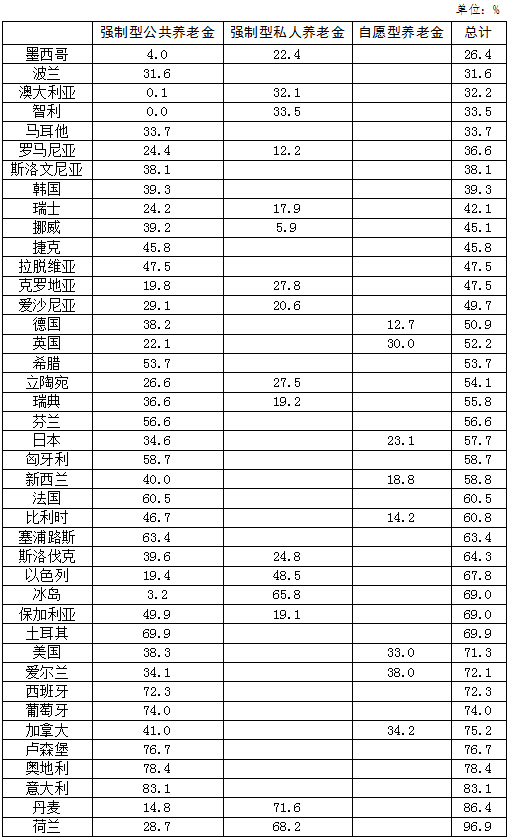

Schedule II

Pension age in some countries in 2016

Source: OECDPensionsataglance2017

Schedule III

Overall situation of pension replacement rate in OECD member countries in 2016

Source: OECDPensionsOutlook2018

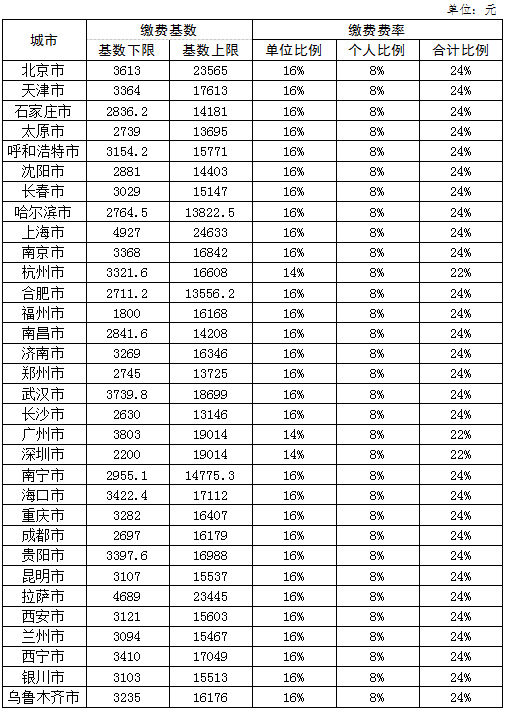

Schedule IV

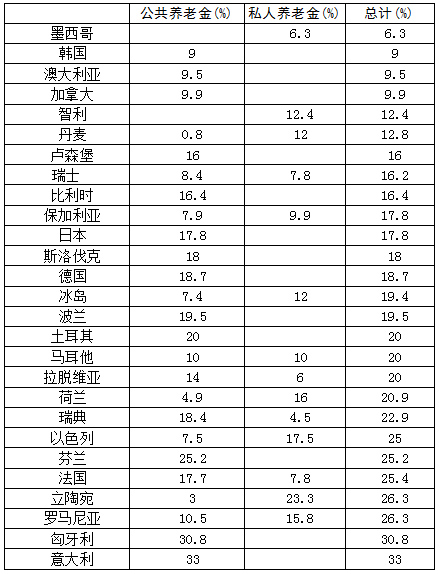

Base and proportion of endowment insurance payment in some places in China in 2019

Data source: according to the websites of local human and social departments.

Reform measures of endowment insurance system in some countries

I. Germany

In order to effectively cope with the aging population and resolve the crisis of pension payment, the general idea of German pension insurance system reform is to control the contribution and subsidy growth of statutory pension insurance on the one hand and reduce the pension obtained by retirees from the first pillar (statutory pension insurance) on the premise of not reducing the overall pension level of pensioners (maintaining the replacement rate of about 70%); On the other hand, support the development of the second and third pillars of pension insurance through subsidies and tax incentives, balance the impact caused by the reduction of statutory pension, and shift the burden of statutory pension insurance and the bottleneck of global competition to enterprises and private pension insurance that are flexible and can adapt to the challenges of globalization. The main measures include:The first is to promote the "compensation conversion" enterprise pension insurance reform.German enterprise pension insurance is a pension formed by voluntary contract between employees and employers. In the past, enterprise pension insurance was only paid by employers. Since 2002, employees have the right to invest part of their gross wages in enterprise pension insurance by means of "compensation conversion" (but since 2019, employers will pay at least 15% of the amount of "compensation conversion"). This part of the salary is tax-free and exempt from social insurance contributions, up to 4% of the statutory pension premium calculation limit.The second is to promote the establishment of a private pension insurance system, including the Rister pension system and the Rukup pension system.In 2002, Germany formally established the Rist pension system. This is a state-funded and personal savings pension insurance system. All employees in Germany can participate, but it is not compulsory. The premium is tax-free, and the insured can only withdraw and use the accumulated insurance money after 60 years old. If employees pay a certain percentage of pre-tax income or give birth to children, they can get state subsidies. Rist pension is operated and managed by financial institutions certified by the state, and the state uses the financial "bottom" to guarantee the payment of this pension in the retirement stage. The Rukup pension, which was launched in 2005, is a commercial pension insurance plan that can be voluntarily insured by individuals who can enjoy a large amount of tax refund from the government. The products are provided by insurance companies, and the pension should be collected after reaching the age of 62.The third is to actively increase the birth rate.Increase investment in family policy, affirm the contribution of raising children, convert the time women spend raising children into the payment period of old-age insurance according to the average wage in various places, encourage the birth of children and improve the fertility rate through indirect social welfare policies and family policies.The fourth is to extend the retirement age.Extend the retirement age in a continuous and slow way: from 2012 to 2022, postpone retirement for one month every year; From 2023 to 2029, retirement will be delayed for two months every year, and finally the retirement age will be extended from 65 years before the reform to 67 years.

Second, France

With the pension insurance system with high welfare becoming more and more difficult to maintain and the pension deficit increasing sharply, France has taken many measures to adjust the pension insurance system.The first is to indirectly reduce the level of protection.Extend the pension calculation and payment base of the public and private sectors from the 10-year average monthly salary with the highest salary level in the career to the highest 25 years. Decoupling the adjustment of basic pension benefits from wages and linking it to the price index.The second is to extend the retirement age.Extend the retirement age from 60 to 62, and extend the retirement age of receiving full basic pension from 65 to 67. Since 2019, those who meet the statutory retirement age and the minimum payment period for receiving a full supplementary pension will not be able to receive a full supplementary pension unless they work more and pay for one year; If retirement is delayed until the age of 64 and above, you will enjoy rewards.The third is to extend the minimum payment period for receiving full basic pension.From the original 37.5 years to 43 years.The fourth is to pay attention to vulnerable groups.We will provide a minimum living guarantee for the poor elderly who have no right to receive pensions, include maternity leave subsidies for women in the pension calculation and payment base, extend the pension exemption time for the unemployed, and stipulate that workers who have worked too long or engaged in heavy labor can retire early.Fifth, adjust the structure of the endowment insurance system.Establish two kinds of fund accumulation pension insurance, namely "enterprise collective retirement savings plan" and "individual retirement pension savings plan", and encourage enterprises and individuals to participate by reducing and exempting enterprise social security contributions and personal income tax, so as to improve the "three pillars" insurance system.

III. Austria

In order to effectively cope with the aging population, Austria actively promotes the reform of the old-age insurance system. Measures taken include:The first is to raise the retirement age of women.Gradually increase the retirement age of women from 60 to 65, which is consistent with the retirement age of men.The second is to implement incentive and restraint policies.Establish an old-age insurance account system for people born after 1955, and implement the "45/65/80" scheme, that is, those who retire at the age of 65 and pay 45 years’ premium will ensure that their pension will reach 80% of their pre-retirement income. At the same time, early retirement is restricted, and it is allowed to retire up to three years in advance (women are prohibited from retiring early), and the treatment level is reduced by 4.5% for every one year in advance; Delayed retirement is encouraged, and the salary level is increased by 4.2% for every one year of delayed retirement.The third is to unify pension accounts.Since 2014, all different types of personal pensions have been unified into a single account, and the annual report system has been implemented. It is expected that the longer you work, the higher your salary will be by reporting the status of pension accounts and the expected salary level after retirement every year.The fourth is to cancel the disability pension and establish a disability rehabilitation center.This will help more disabled people to return to the job market instead of directly retiring.

IV. Norway

The third round of pension reform in Norway since 2011 focuses on promoting the employment of the elderly and expanding the labor participation of the whole society, which has the following characteristics:The first is to establish a "selective" retirement system.Before the reform, Norway’s legal retirement age was 67, and people who had worked for 40 years could receive a pension. After the reform, employees can voluntarily apply for retirement from the age of 62, but the total present value of pensions is expected to remain unchanged. The earlier they retire voluntarily, the less they will receive annual pensions. At the same time, the New Deal allows employees to continue to work full-time while receiving pensions, which is very flexible and the rights and interests are guaranteed.The second is to establish corresponding supporting institutional arrangements.We will implement the active employment policy for the elderly, set up a special policy center for the elderly, actively promote various activities aimed at encouraging the employment of the elderly, and promote the formation of joint forces among the government, enterprises, trade unions and social organizations. We will improve laws and regulations that encourage the elderly to take active jobs, prohibit employers from dismissing employees under 70 just because they have reached the statutory retirement age, and consider raising the age limit to 75.The third is to improve the fiscal and taxation policies that support the extension.Preferential tax policies such as tax reduction and exemption and deferred taxation are adopted to encourage the elderly to delay retirement, work longer hours and make more contributions. Through the reform of retirement system and structural policy arrangements, a virtuous circle of "delaying retirement-increasing labor supply-improving productivity-expanding tax base-improving the sustainability of pension expenditure" has been formed.